Global Construction Lubricants Market – Analysis and Forecast (2026-2035)

Industry Insight by Base Oil Type (Mineral Oil, Synthetic Oil, and Bio-based Oil.), By Product Type (Engine Oil, Hydraulic Fluids, Gear Oil, Greases, and Others), By Equipment Type (Earthmoving, Material Handling, Heavy Construction, and Other) and By Geography (North America, Europe, Asia-Pacific, Middle East, and Rest of the World)

| Status : Published | Published On : Sep, 2025 | Report Code : VRCH2093 | Industry : Chemicals & Materials | Available Format :

|

Page : 300 |

Global Construction Lubricants Market – Analysis and Forecast (2026-2035)

Industry Insight by Base Oil Type (Mineral Oil, Synthetic Oil, and Bio-based Oil.), By Product Type (Engine Oil, Hydraulic Fluids, Gear Oil, Greases, and Others), By Equipment Type (Earthmoving, Material Handling, Heavy Construction, and Other) and By Geography (North America, Europe, Asia-Pacific, Middle East, and Rest of the World)

Construction Lubricants Market Overview

The market for Construction Lubricants is anticipated to increase significantly, going from USD 13.28 billion in 2025 to USD 18.25 billion in 2035 with the CAGR 4.1% . The construction lubricant market is responsible for producing, distributing, and using lubricants designed for construction equipment and machinery. These lubricants are crucial for ensuring the smooth operation, efficiency, and longevity of various equipment, such as excavators, bulldozers, cranes, loaders, and trucks. The market is driven by factors such as the growth of the construction industry, infrastructure development projects, urbanization trends, and government investments in construction and public works. The market includes various categories of lubricants, such as engine oils, hydraulic fluids, gear oils, transmission fluids, and greases, each serving a unique purpose in lubricating and protecting different parts of construction equipment. Technological advancements in lubricant formulations are characterized by improved properties, such as better viscosity control, thermal stability, increased load-carrying capacity, and resistance to extreme temperatures and harsh operating conditions. These advancements aim to provide better lubrication and protection, leading to increased equipment efficiency and reduced maintenance costs.

Additionally, the construction lubricant market is experiencing a surge in demand for environmentally friendly and sustainable lubricants. Manufacturers are developing bio-based, low-toxicity, and biodegradable lubricants to meet strict regulations and reduce environmental impact. The highly competitive market includes global and regional players investing in research, development, strategic partnerships, and product innovations. They also offer technical support, training, and maintenance services to enhance their value proposition.

Overall, the demand for effective and dependable lubricating solutions to support the expansion of the construction sector drives the construction lubricant market. With ongoing developments in lubricant technology and a greater emphasis on sustainability, the market is likely to rise significantly in the coming years.

Construction Lubricants Market Segmentation

Insight by Base Oil Type

- Mineral Oil

- Synthetic Oil

- Bio-Based Oil

The mineral oil category holds a larger share of the construction lubricant market and it will continue to dominate in the projected period. This is attributed to its low cost and the broad availability of mineral oil-based lubricants. Many kinds of lubricants are used in construction equipment such as hydraulic fluid and gear oil most of which contain mineral oil. However synthetic oil is also anticipated to grow at the highest CARG during the forecast period due to its superior quality and durability.

Insight by Product Type

- Engine Oil

- Hydraulic Fluids

- Gear Oil

- Greases

- Others

Engine oil holds the largest share of its market. The engine oil segment in the construction lubricant market is expected to grow at the highest CAGR during the forecast period. This highest growth is driven by the increasing demand for construction equipment, the adoption of process automation solutions, and the growing focus on sustainability. Factors driving this growth include the increasing demand for infrastructure development in emerging economies, the adoption of process automation solutions, and the development of environmentally friendly engine oil formulations. However, challenges such as rising raw material prices and competition from synthetic engine oils pose challenges to the growth of the engine oil segment.

Insight by Equipment Type

- Earthmoving

- Material Handling

- Heavy Construction

- Others

The heavy construction vehicles segment is the fastest-growing in the construction lubricant market due to its widespread use in various applications like road construction, mining, and quarrying. The global infrastructure market is expected to grow at a faster pace during the forecast period, driven by emerging economies like China, India, and Brazil. The construction industry is also adopting new technologies like automation and robotics, which require heavy construction vehicles. Additionally, the growing focus on sustainability is driving the development of fuel-efficient and environmentally friendly heavy construction vehicles, necessitating lubricants that meet these performance and environmental requirements.

Global Construction Lubricants Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 13.28 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 18.25 Billion |

|

Growth Rate |

4.1% |

|

Segments Covered in the Report |

By Base Oil Type, By Product Type, By Equipment Type |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Industry Dynamics

Construction Lubricants Market Growth Drivers

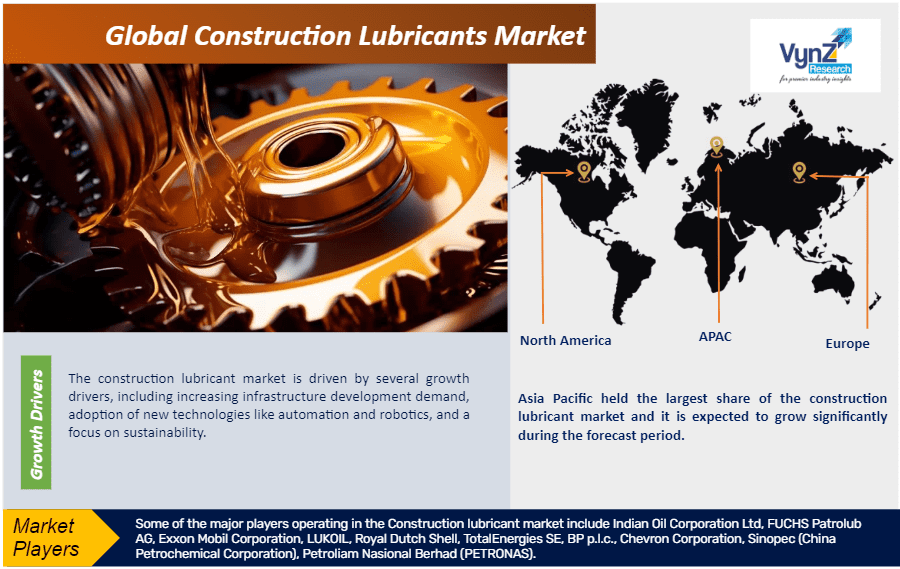

The construction lubricant market is driven by several growth drivers, including increasing infrastructure development demand, adoption of new technologies like automation and robotics, and a focus on sustainability. These factors create new opportunities for lubricant manufacturers to develop and market environmentally friendly lubricants that meet the performance and environmental requirements of these technologies. Rising disposable incomes in emerging economies also drive the demand for construction projects, further driving the demand for lubricants.

Moreover, technological advancements, such as automation and robotics, also require lubricants that meet the performance and environmental requirements of these technologies. Government regulations aimed at reducing pollution and emissions from construction equipment also drive the demand for environmentally friendly lubricants. Overall, the construction lubricant market is expected to continue growing due to these factors.

Construction Lubricants Market Challenges

The construction lubricants market faces several key challenges despite anticipated growth driven by global infrastructure development. One major challenge is the rising complexity of construction equipment, especially with the adoption of automation, robotics, and advanced machinery. These technologies demand high-performance, specialized lubricants, increasing formulation and production costs. Additionally, the market must navigate stringent environmental regulations, particularly around emissions and the use of biodegradable or eco-friendly lubricants, which require significant investment in research and development.

Fluctuating crude oil prices and raw material costs further pressure lubricant manufacturers, impacting profit margins and pricing strategies. Supply chain disruptions, partly due to geopolitical tensions and global economic uncertainties, continue to affect the timely delivery of lubricants and additives. In emerging markets such as India, China, and Brazil—key drivers of construction growth—issues like inconsistent enforcement of quality standards and lack of awareness among end-users also pose barriers.

Construction Lubricants Market Opportunities

The construction lubricant market is experiencing new opportunities due to the adoption of new technologies. These technologies require lubricants that meet performance and environmental requirements, such as those for robots and 3D-printed parts. Additionally, these technologies can improve existing lubricants by enhancing their performance and making them more environmentally friendly. Additionally, new market opportunities arise for lubricant manufacturers, as the development of new robots and 3D printing technologies has led to increased demand for lubricants specifically designed for these applications. As the construction industry continues to grow, lubricant manufacturers that can adapt to these changes are well-positioned to succeed in this rapidly growing market.

Therefore, lubricant manufacturers are capitalizing on the opportunities in the construction industry by adopting new technologies such as Shell Lubricants has developed a new line of lubricants for robots, ensuring high temperatures and non-flammability, making them ideal for harsh environments. This innovative approach enables them to meet the demands of the growing market.

Construction Lubricants Market Geographic Overview

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Vietnam

- Thailand

- Malaysia

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

Asia Pacific held the largest share of the construction lubricant market and it is expected to grow significantly during the forecast period. This is due to factors such as increasing infrastructure development, growing population, market demands, adoption of new technologies like automation and robotics, and government regulations reducing pollution and emissions from construction equipment. China, India, and Indonesia are expected to dominate the construction lubricant market, driven by significant market growth in the construction sector in these regions. The demand for environmentally friendly lubricants is expected to rise due to these factors.

Additionally, the market will expand as individuals become more aware of the benefits of utilizing high-quality, long-lasting, and environmentally friendly lubricants for equipment.

Construction Lubricants Market Competitive Insight

The key players in the market are adopting various business growth strategies in order to expand their presence and gain a competitive edge. Product innovation, pricing, customer services, research, and development are the key business growth strategies that are being adopted by the players in the construction lubricant market:

ExxonMobil is a prominent player in the worldwide lubricants business, and it is dedicated to offering new construction products and services. The company announced an agreement with Caterpillar to create new construction lubricants. Their partnership will center on creating items that address the unique requirements of Caterpillar machinery.

Indian Oil Corporation (IOC) has partnered with FuelBuddy, India's largest legal doorstep fuel delivery service, to market IOC's lubricants. The partnership will enable FuelBuddy to deliver IOC lubricants to customers across India. As well as IOC plans to increase its lubricants production capacity by 10%.

Recent Development by Key Players

Russia's Lukoil has established a new oil trading entity in Dubai, Alghaf Marine DMCC, to replace its previously sanctioned trading arm, Litasco Middle East (LME) DMCC, to tightening Western sanctions on Russian energy exports.

Malaysia’s Petroliam Nasional Berhad (Petronas) has secured a deal with Mahindra & Mahindra Ltd. Petronas Lubricants International (PLI) and Petronas Lubricants (India) Pvt. Ltd. bagged an aftermarket service fill contract from India’s largest sports utility vehicle (SUV) manufacturer. Petronas Lubricants will be the sole distributor of vehicle fluids to Mahindra’s authorized dealers, workshops, and stockists under the Maximile brand within Mahindra’s South Zone Distribution network in India.

Key Players Covered in the Report

- Indian Oil Corporation Ltd

- FUCHS Patrolub AG

- Exxon Mobil Corporation

- LUKOIL

- Royal Dutch Shell

- TotalEnergies SE

- BP p.l.c.

- Chevron Corporation

- Sinopec (China Petrochemical Corporation)

- Petroliam Nasional Berhad (PETRONAS)

The Construction Lubricants Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2026–2035.

.png)

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Construction Lubricants Market