Fungicides Market Overview

The global fungicides market size was valued at USD 23.6 billion in 2023. It is expected to reach up to USD 33.8 billion by 2030 registering a CAGR of 6.80% during the forecast period ranging between 2025 and 2030.

Fungicides refer to special types of biological or chemical agents. These are typically used to inhibit and prevent the growth of fungi or fungal spores on crops, damaging production. These agents play a crucial role in agriculture, helping the farmers to produce crops free from any fungal infection or disease such as rusts, blights, and molds. It also improves their quality and shelf life. Fungicides are available in different forms, such as sprays, dust, and seed treatments and can be used safely on vegetables, fruits, cereals, and even on ornamental plants.

The global fungicides market growth is primarily driven by the significant rise in the demand for food worldwide and the growing incidences of fungal diseases affecting crop yield. The growing world population necessitates an increase in crop production and food security demands. This results in higher adoption of fungicides to protect crops from fungal infections and diseases. Moreover, the rise in fungal diseases in crops is attributed mainly to climate change, which is now warmer and more humid, creating a perfect environment for fungi to thrive. This also results in a higher reliance on fungicides to protect crops, thereby pushing the market forward.

However, the market growth is hindered by a few specific challenges, such as the growing regulatory restrictions on the use of chemical-based fungicides due to the potential environmental impacts and health effects. Several governments and environmental agencies are imposing stern regulations on the use of synthetic fungicides, which restricts market growth. Manufacturers, as a result, now focus on producing bio-based fungicides to meet the growing consumer demand for eco-friendly and sustainable products. These organic and biologically derived fungicides, due to the shift toward bio-based alternatives, have opened new growth opportunities for the market.

Global Fungicides Market Report Coverage

|

Report Metric

|

Details

|

|

Historical Period

|

2020 - 2024

|

|

Base Year Considered

|

2025

|

|

Forecast Period

|

2026 - 2035

|

|

Market Size in 2025

|

U.S.D. 23.6 Billion

|

|

Revenue Forecast in 2035

|

U.S.D. 33.8 Billion

|

|

Growth Rate

|

6.80%

|

|

Segments Covered in the Report

|

Product Type, Application, Formulation Type and Crop Type

|

|

Report Scope

|

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling

|

|

Regions Covered in the Report

|

North America, Europe, Asia Pacific, Middle East and Africa

|

Global Fungicides Industry Dynamics

Global Fungicides Market Trends/ Growth Drivers:

Move Toward Biopesticides

A notable trend in the global fungicides market is the higher preference and shift toward environmentally friendly biopesticides. These products help meet the rising demand from regulators and consumers for natural and organic fungicides derived from biological sources that prioritize sustainability. Additionally, a broader movement is also reflected by the move toward integrated pest management practices. These approaches minimize the usage of chemical pesticides while controlling fungal diseases most effectively. The significant developments in biotechnology and the creation of innovative biopesticides with higher efficiency and safety profiles to address environmental concerns more effectively are also worth noting.

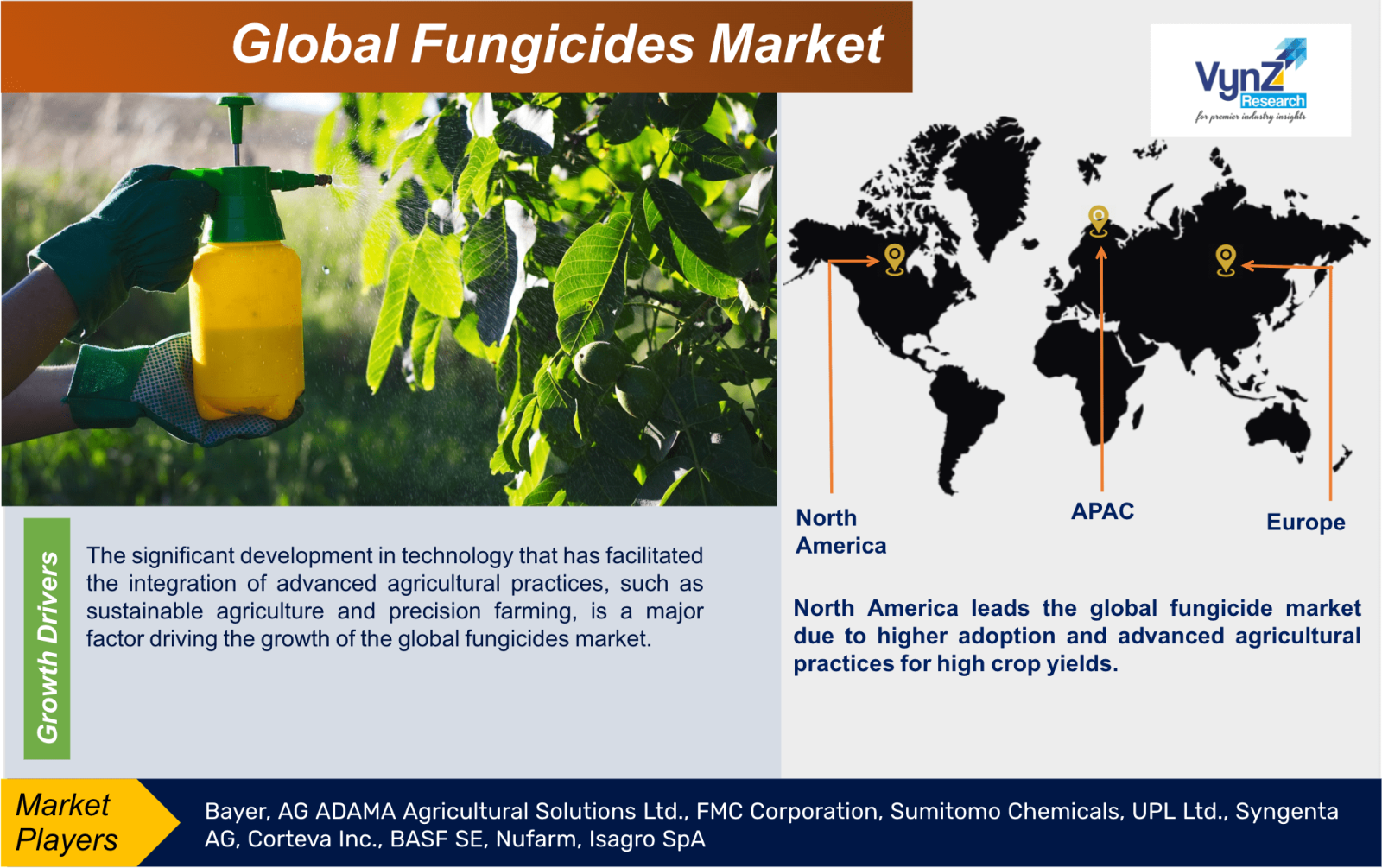

The significant development in technology that has facilitated the integration of advanced agricultural practices, such as sustainable agriculture and precision farming, is a major factor driving the growth of the global fungicides market. This has resulted in higher adoption and use of fungicides by farmers to effectively protect their crops. Target application with a minimum amount reduces waste and also enhances crop health and production.

Increasing Organic Farming

The rise in demand for bio-based fungicides, especially in organic agriculture, is also a significant factor driving the growth of the global fungicide market. Typically, these organic fungicides are made from natural ingredients and have gained significant traction due to the growing consumer preference for organic food products. These alternatives are extremely environmentally friendly and can manage fungal infections in crops without compromising organic guarantees. Since more countries are moving to sustainable farming practices, this will push the demand for organic fungicides and, thereby, the market.

Government Policies and Subsidies

Supportive government policies and subsidies encourage the use of fungicides and improve agricultural productivity. This also plays a crucial role in the market growth. Several countries in Asia-Pacific and Latin America especially have launched different programs to support and encourage farmers to adopt these solutions for crop protection and yield growth. Governments also provide technical assistance in regions where agriculture is a major economic contributor. Such initiatives increase awareness of the benefits of using fungicides, which significantly contributes to the growth of the global fungicides market.

Increase in popularity of Horticulture and Ornamental Plants

The growing popularity of horticulture and ornamental plants and their increasing demand, especially in urban areas and developing regions, also contribute to the market growth. These specific plants are more susceptible to fungal infections resulting in potential economic losses in the horticultural sector. Fungicides help protect these plants from fungal infections and diseases and promote their quality and marketability, fueling the market expansion further.

Global Fungicides Market Challenges

Increasing Resistance of Fungi

The increasing resistance of fungi to fungicides is one of the most significant challenges for the growth of the global fungicides market. The commonly used fungicides are especially ineffective due to the developed resistance of fungi, which decreases crop production. Often, higher doses or entirely new formulations are required for effectiveness and increased crop production, but it also increases the production cost for farmers and manufacturers. Furthermore, the lack of awareness among the farmers and the inappropriate use of fungicides contribute to the issue. The companies find it hard to develop new and effective products for the resistant strains, which slows down the market growth.

Global Fungicides Market Opportunities

Increasing Demand in Developing Markets

A significant growth opportunity is offered to the global fungicide market by the significant increase in the demand for fungicides in the developing agricultural sector in emerging markets, especially in the Asia-Pacific, Latin American, and African markets. This is mainly attributed to the rapid population growth as well as the consequent increased demand for food production. Moreover, the rising investments in the agricultural sector, along with the significant technological developments in the developing countries especially, are supporting higher adoption of fungicides due to their notable shift towards modern sustainable farming practices to boost productivity, creating novel growth opportunities for manufacturers to expand their presence in growing markets.

Recent Development by Key Players

BASF has introduced Aramax Intrinsic brand fungicide which is a dual-active fungicide that delivers broad-spectrum control of 26 cool and warm season turf diseases like large patch, brown patch, snow mold and dollar spot on golf course fairways. This brand fungicide combines the strength of two powerful active ingredients, triticonazole and pyraclostrobin, for long-lasting residual disease control up to 28 days.

The newly launched bio-fungicide product by Bayer has amplified quality and crop yield, that offers a safe, effective and environment-friendly crop protection solution for Vietnamese farmers, to meet stringent international standards.

Global Fungicides Market Segmentation

Insight by Product Type

- Chemical Fungicides

- Biological Fungicides

Biological fungicides segment dominates due to growing awareness of food safety and environmental sustainability

The global fungicides market is segmented by product type into Chemical Fungicides and Biological Fungicides. Among these two segments, the biological fungicides segment will dominate and grow at a rapid rate during the forecast period due to growing awareness of food safety and environmental sustainability, rising demand for sustainable agriculture practices, a shift towards organic farming, and strict regulations on using chemicals. The chemical fungicides segment, on the other hand, is also expected to grow quite significantly due to higher effectiveness, which promotes widespread adoption and use in agriculture. Furthermore, within this specific segment, azoles will be most significant due to their higher efficacy against different types of fungal pathogens.

Insight by Application

- Agriculture

- Horticulture

- Turf

- Ornamentals

Agriculture segment dominates the market due to higher adoption and crop protection needs

Diverse applications also divide the global fungicides market into different categories such as Agriculture, Horticulture, Turf, and Ornamentals. Out of all these segments, the agriculture segment holds the largest share of the market due to greater adoption and the need to protect crops from fungal infections and diseases. Furthermore, within this specific segment, the application of fungicides on cereals is most predominant mainly because these crops are indispensable for worldwide food security. The horticulture segment will also grow quite rapidly during the projected period due to higher demand for fresh produce.

Insight by Formulation Type

Liquid formulations dominate the market due to higher effectiveness and ease of application

The global fungicides market is categorized by different formulations as well into Liquid, Powder, And Granules. Among them, liquid formulations dominate the market due to their higher effectiveness and ease of application. The suspension concentrates in this specific subsegment will, however, display noteworthy growth during the forecast period due to a higher ability to deliver high performance and lower concentrations of active ingredients. However, the powder formulations segment will also grow, being a much safer alternative, especially for use in organic farming.

Insight by Crop Type

- Cereals

- Fruits and Vegetables

- Oilseeds

- others.

The cereals segment dominates due to their vital role in food supply chains

Different types of crops also divide the global fungicides market into Cereals, Fruits and Vegetables, Oilseeds, and others. Among them, the cereals segment dominates due to their crucial participation in food supply chains. However, growing health consciousness among people will drive the growth of the fruits and vegetables segment during the projected period further due to their preference for organic produce.

Global Fungicides Market: Geographic Overview

- North America

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Vietnam

- Thailand

- Malaysia

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

North America leads the global fungicide market due to higher adoption and advanced agricultural practices for high crop yields. It is also attributed to the higher adoption of precision farming techniques, integrated pest management strategies, stringent regulations, technological adoption, and significant investments.

The market in Europe is growing due to strict regulatory standards, a shift toward sustainable agricultural practices, growing demand for organic and bio-based fungicides, shifting consumer preferences for eco-friendly products, and increasing investments in research to develop innovative fungicide solutions.

The Asia-Pacific region will grow at a higher rate during the forecast period, being the major contributor to the market due to higher agricultural production, growing pest pressure and better management techniques, rapid population growth, higher demand for food security, and increased investment in agriculture.

The Middle East and Africa region is expected to grow due to an increase in agricultural activities, growing awareness of fungicides and crop protection, supportive government initiatives to promote sustainable farming practices, and rising investments in agricultural technology, especially in developing economies in this region.

Global Fungicides Market Competitive Insight

The report provides a comprehensive analysis of the competitive landscape in the market. Some of the key players in the market include:

- Bayer AG

- ADAMA Agricultural Solutions Ltd.

- FMC Corporation

- Sumitomo Chemicals

- UPL Ltd.

- Syngenta AG

- Corteva Inc.

- BASF SE

- Nufarm

- Isagro SpA

.png)

Source: VynZ Research

.png)

.png)