Gas Turbines Market Overview

The Global Gas Turbines Market is anticipated to grow from USD 20.2 billion in 2023 to USD 27.5 billion in 2030 at a CAGR of 3.9% during the forecast period from 2025 to 2030.

The gas turbine is the internal - combustion engine at the core of Gas Turbine Combined Cycle (GTCC) power plants. Increasing energy demand is the major driver for the growth of the gas turbines market. Efficient and reliable power generation solutions are necessary which is fueled by rapid industrialization and urbanization. Due to the quick startup capabilities and remarkable fuel efficiency, turbines emerged as a preferred choice. The energy demand continues to rise, due to the expansion of cities and industries making the turbines as a crucial player in meeting the evolving energy requirements around the world. Furthermore, the growing electrification of various sectors are contributing factors to the rising demand for robust energy solutions.

The market is segregated by design type such as heavy duty and aeroderivative segment, where heavy duty dominates the market, and by technology like open and combined cycle which shall grow due to its efficiency. It is also divided by rated capacity where above 300 segment shall grow more than the others. Power generation, oil and gas and mobility are the segments divided based on the applications, where power generation dominates the market.

Market Segmentation

Insight by Design Type

Based on design type, the Gas Turbines Market is segmented into heavy duty and aero-derivative. The heavy duty type emerged as the largest segment as these gas turbines are robust, large-scale machines designed for high-power applications, such as utility and industrial power plants. They are durable, have extended operational life and ability to handle continuous, base-load power generation.

Insight by Technology

The gas turbines market is bifurcated into open cycle and combined cycle on the basis of technology. Combined cycle gas turbine accounts for the majority of the market share as it integrates both gas and steam turbines which helps in optimizing energy efficiency by utilizing the waste heat from the gas turbine to produce additional electricity through the steam turbine.

Insight by Rated Capacity

The gas turbine market segmentation based on rated capacity includes 1-40 MW, 40-120 MW, 120-300 MW and above 300 MW. Among these segments, above 300 MW leads the market as these turbines are substantial powerhouses used in large-scale, utility-grade power plants. These turbines are of high output and efficiency

Insight by End-User

Based on end-user, the gas turbines market is segmented into power generation, oil and gas, mobility and others. Power generation represents the leading market segment as it plays an important role in the applications, from large utility-scale power plants to distributed energy systems. The "Mobility" segment also represents a diverse range of applications where gas turbines contribute to propulsion systems.

Global Gas Turbines Market Report Coverage

|

Report Metric

|

Details

|

|

Historical Period

|

2020 - 2024

|

|

Base Year Considered

|

2025

|

|

Forecast Period

|

2026 - 2035

|

|

Market Size in 2025

|

U.S.D. 20.2 Billion

|

|

Revenue Forecast in 2035

|

U.S.D. 27.5 Billion

|

|

Growth Rate

|

3.9%

|

|

Segments Covered in the Report

|

By Design Type, By Technology, By Rated Capacity, By End-User

|

|

Report Scope

|

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling

|

|

Regions Covered in the Report

|

North America, Europe, Asia-Pacific, Latin America, Middle East And Africa

|

Industry Dynamics

Growth Drivers

Ongoing innovations in design principles, materials and control systems has propelled the performance of the gas turbines to extraordinary levels. Also rapid technological advancements is leading to the growth of this market. The integration of cutting-edge digital technologies, like predictive maintenance and advanced monitoring systems, enhances reliability and minimizes downtime, solidifying these turbines as a forefront technology in power generation. Broad research and development (R&D) initiatives are ensuring these turbines to remain at the forefront of technological innovation. Rising environmental sustainability is one of the major factors steering the growth of the gas turbine market. These turbines produce significantly lower emissions compared to conventional power generation methods and stand out as environmentally responsible alternatives. The global market is experiencing vigorous growth which is driven by the need for cleaner energy sources, increasing energy demands and infrastructure development.

Restraints

Environmental concerns and regulatory pressures are driving the need for cleaner technologies. However, these challenges can be addressed through advancements in turbine efficiency, emissions reduction and embracing digital solutions for predictive maintenance .

Geographic Overview

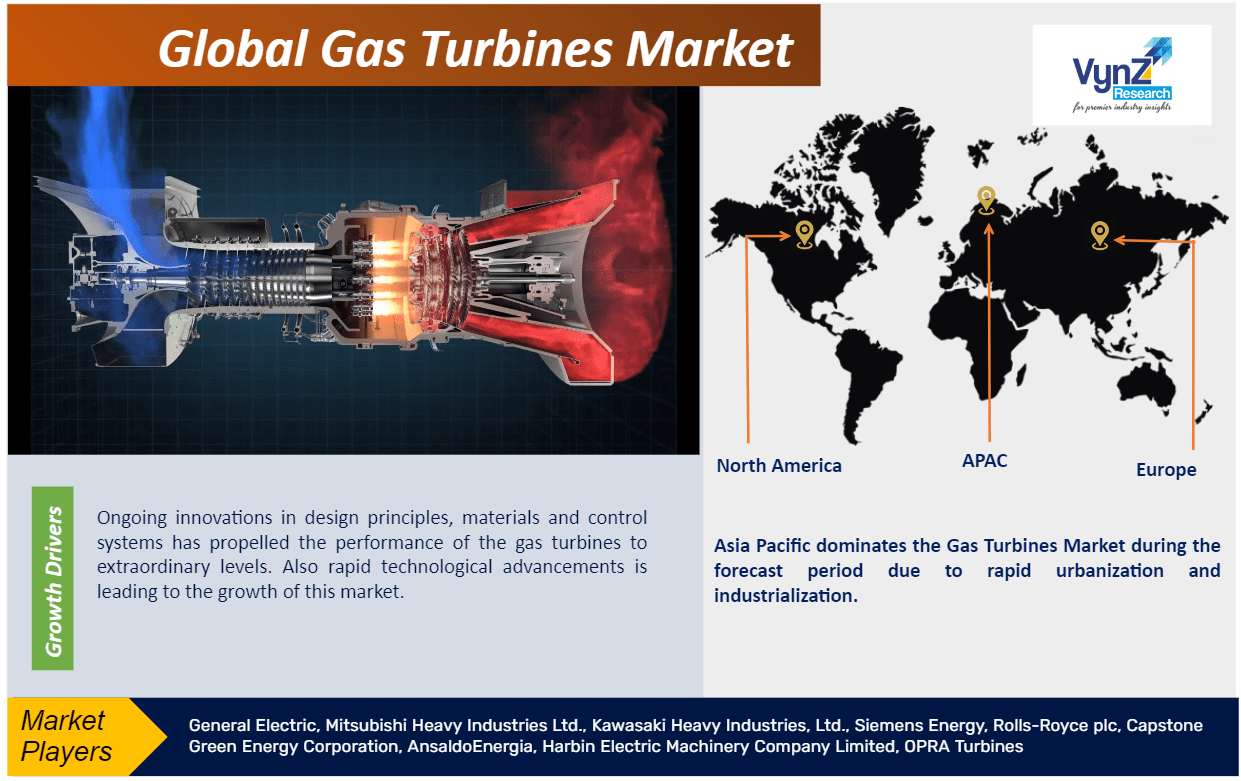

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa

Asia Pacific dominates the Gas Turbines Market during the forecast period due to rapid urbanization and industrialization whereas other regions, including North America and Europe, focus on sustainable energy transitions. The Middle East and Africa influence gas turbines for infrastructure development and oil and gas operations

Competitive Insights

The major players actively investing in partnerships, research and development and acquisitions. Companies are striving to enhance their technological capabilities, offer innovative solutions to meet evolving customer demands and expand market reach.

Mitsubishi Heavy Industries Group has extensive experience in developing gas turbines and has integrated the latest technologies in aerodynamics, cooling design and materials to create a variety of highly efficient and reliable products. The state-of-the-art J-series gas turbines have consistently led the world, achieving the world’s largest capacity and highest efficiency. Group offer a wide range of gas turbines from 30MW to 560MW class, that meets diverse needs around the world. It is the only company in Japan that can handle the entire production process from development, design, manufacturing, construction, and test run to after-sales service for large capacity thermal power plants and their core equipment using its proprietary technologies.

GE offers a wide array of equipment options and models to meet your most challenging energy requirements as the world’s largest manufacturer and supplier of gas turbine technology.

Key Players Covered in the Report

Some of the key players in this market are General Electric, Mitsubishi Heavy Industries Ltd., Kawasaki Heavy Industries, Ltd., Siemens Energy, Rolls-Royce plc, Capstone Green Energy Corporation, AnsaldoEnergia, Harbin Electric Machinery Company Limited, OPRA Turbines

Recent developments by Key Players

GE Vernova successfully completes modernization of 4 gas turbines at Kuwait’s Sabiya power plant that shall boost efficiency and increase the overall output. This will allow more power to be produced without increasing fuel consumption and the resulting carbon dioxide emissions, which would amount to the equivalent of approximately another 16,000 cars being put on Kuwait's roads.

NTPC Ltd., signed a Memorandum of Understanding (MoU) with Mitsubishi Heavy Industries, Ltd. Japan and its subsidiary Mitsubishi Power India Private Limited to demonstrate the feasibility for Hydrogen co-firing blended with natural gas in MHI 701D gas turbines installed at NTPC Auraiya Gas Power Plant in Uttar Pradesh.

Segments Covered in the Report

- By Design Type

- Heavy duty

- Aeroderivative

- By Technology

- Open cycle

- Combined cycle

- By Rated Capacity

- 1-40 MW

- 40-120 MW

- 120-300 MW

- Above 300 MW

- By End-User

- Power Generation

- Oil and Gas

- Mobility

- Others

Region Covered in the Report

- North America

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Argentina

- Rest of Latine America

- Middle East and Africa

- Turkey

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

.png)

Source: VynZ Research

.png)

Source: VynZ Research

.png)

.png)