GCC Facility Management Market – Analysis and Forecast (2025-2030)

Industry Insights by Service (Property [HVAC Maintenance, Mechanical and Electrical Maintenance, and Others], Cleaning, Environmental Management, Security, Support, Catering, and Others), by Type (Hard, Soft, and Others), by Mode (Outsourced [Integrated, Single, and Bundled], and In-House), by End-User (Commercial, Industrial, and Residential), and by Country (Saudi Arabia, Qatar, U.A.E, Kuwait, and Rest of GCC)

| Status : Published | Published On : Dec, 2023 | Report Code : VREP3010 | Industry : Energy & Power | Available Format :

|

Page : 135 |

GCC Facility Management Market – Analysis and Forecast (2025-2030)

Industry Insights by Service (Property [HVAC Maintenance, Mechanical and Electrical Maintenance, and Others], Cleaning, Environmental Management, Security, Support, Catering, and Others), by Type (Hard, Soft, and Others), by Mode (Outsourced [Integrated, Single, and Bundled], and In-House), by End-User (Commercial, Industrial, and Residential), and by Country (Saudi Arabia, Qatar, U.A.E, Kuwait, and Rest of GCC)

GCC Facility Management Market Overview

The GCC Facility Management Market is predicted to grow at 9.7% CAGR during the forecast period with the market size reaching USD 90.8 billion by 2030. Different services such as property, cleaning, environmental management, security, support, catering, and others (contract management, utility management, furniture supplies, and reception staffing) are majorly contributing to the facility management market size. The market has witnessed significant demand for property over the last few years due to its advantages such as minimal maintenance and repair price, reduced occupant turnover, support with taxes, rent collection, and small vacancy cycles.

Market Segmentation

Insight by Service

Based on the service, the GCC facility management market is categorized into property, cleaning, environmental management, security, support, catering, and others (contract management, utility management, furniture supplies, and reception staffing) of which property holds the largest share during the historic period in the facility management market due to its advantages such as minimal maintenance and repair price, reduced occupant turnover, support with taxes, rent collection, and small vacancy cycles.

Moreover, the catering segment is predicted to grow at the fastest growth during the forecast period owing to mounting tourism and hospitality industry. The property segment is further subdivided into heating, ventilation, and air conditioning (HVAC) maintenance, mechanical and electrical maintenance, and others.

Insight by End User

On the basis of the end user, the GCC facility management market is segmented into commercial, industrial, and residential. Of all, the commercial category is predicted to witness the highest CAGR of 9.8% during the forecast period and accounted for the largest share in the facility management market due to escalating alertness among end users for commercial building maintenance to minimize expenditure. Moreover, the benefits it offers to commercial users to sustain emphasis on their core capabilities to improve their attractiveness in the market and sustain their resources at a consistent time.

Insight by Mode

On the basis of mode, the GCC facility management market is segmented into outsourced, and in-house. Of all, the in-house category accounted for the larger share in the market due to elevated acceptance rate, long-standing existence, and comparatively low price. The outsourced segment is further subdivided into integrated, single and bundled.

Insight by Type

On the basis of the type, the GCC facility management market is segmented into hard, soft and others. Of all, hard category accounted for the largest share in the facility management market due to the high cost.

Global GCC Facility Management Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. XX Billion |

|

Revenue Forecast in 2035 |

U.S.D. 90.8 Billion |

|

Growth Rate |

9.7% |

|

Segments Covered in the Report |

By Service, By End User, By Mode, By Type |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Industry Dynamics

Industry Trends

The regulatory and financial development in GCC countries and the advancement of outsourced facility management services are the major trends in the GCC facility management market.

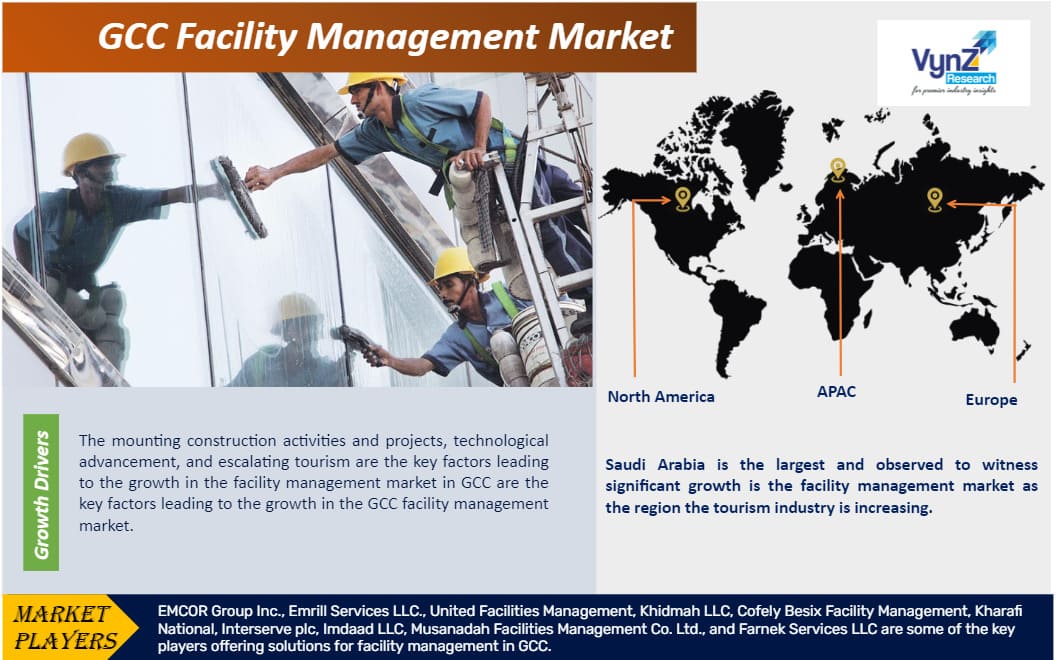

Growth Drivers

The mounting construction activities and projects, technological advancement, and escalating tourism are the key factors leading to the growth in the facility management market in GCC are the key factors leading to the growth in the GCC facility management market.

Some of the other key factors driving the growth of the industry are mounting need of outsourced facility management and escalating emphasis on non-oil sectors. The flexibility that is required to encounter the continuously altering business needs and necessities would result, the immense opportunity for the outsourced facility management services.

Challenges

Key factors hindering the growth of the GCC facility management market are inflationary pressure on the facility management service industry, and high standards.

Geographic Overview

Geographically, Saudi Arabia is the largest and observed to witness significant growth is the facility management market as the region the tourism industry is increasing. In addition, expanding construction activities, and rapid urbanization are also driving the growth of the Saudi Arabia facility management market.

Competitive Insight

EMCOR Group, Inc. is an American mechanical and electrical construction, industrial and energy infrastructure, and building services company based in Norwalk, Connecticut. It comprises 100 or more operating companies, has approximately 180 locations, and employs more than 38,000 people.

United Facilities Management offers a wide range of facilities management services delivered through a fully integrated platform that is flexible, comprehensive and complete.

EMCOR Group Inc., Emrill Services LLC., United Facilities Management, Khidmah LLC, Cofely Besix Facility Management, Kharafi National, Interserve plc, Imdaad LLC, Musanadah Facilities Management Co. Ltd., and Farnek Services LLC are some of the key players offering solutions for facility management in GCC.

Recent Developments by Key Players

Emrill (UAE-based facilities management services provider) has been awarded a facilities management contract for One Za’abeel, one of Dubai’s most innovative and distinctive mixed-use developments. Emrill shall provide integrated facilities management services, including specialist services, to the luxury mixed-use development.

Aldar Properties (International Holding Company (IHC)) and Adnec Group have merge their jointly owned property and facilities management businesses within the Aldar Estates platform. This merger shall see IHC and Adnec Group become strategic shareholders in Aldar Estates, with Aldar retaining a majority stake and control of the combined platform.

The GCC Facility Management Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

- Service Insight and Forecast 2025-2030

- Property

- Heating, Ventilation, and Air Conditioning (HVAC) maintenance

- Mechanical and electrical maintenance

- Others

- Cleaning

- Environmental management

- Security

- Catering

- Others

- Property

- End User Insight and Forecast 2025-2030

- Commercial

- Industrial

- Residential

- Mode Insight and Forecast 2025-2030

- Outsourced

- Integrated

- Single

- Bundled

- In-House

- Outsourced

- Type Insight and Forecast 2025-2030

- Hard

- Soft

- Others

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

PRIMARY RESEARCH INTERVIEWS - BREAKDOWN

.png)

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

GCC Facility Management Market