Saudi Arabia Facility Management Market Overview

The Saudi Arabia facility management market which was valued at approximately USD 35.30 billion in 2025 and is estimated to rise further up to around USD 38.75 billion by 2026, is projected to reach nearly USD 89.58 billion by 2035, expanding at a CAGR of about 9.7% during the forecast period from 2026 to 2035.

Market growth is primarily driven by rapid urban infrastructure development, increasing adoption of integrated facility management services, and rising emphasis on operational efficiency in commercial and industrial facilities. Growing demand for energy-efficient building management, smart facility solutions, and ongoing government initiatives under Saudi Vision 2030 are further supporting market expansion across major regions including Riyadh, Jeddah, and Dammam.

Integrated services focusing on hard services such as mechanical, electrical, and plumbing maintenance, along with soft services including cleaning, security, and landscaping, are increasingly adopted by corporate, healthcare, and industrial facilities. Technology-driven solutions, such as IoT-enabled monitoring, predictive maintenance, and automated energy management, are enhancing service efficiency and reducing operational costs. Continuous investments in smart building initiatives and regulatory frameworks promoting safety, sustainability, and workplace productivity further reinforce market demand across the country.

Saudi Arabia Facility Management Market Dynamics

Market Trends

The industry is witnessing notable shifts in service delivery models, technology adoption, and regulatory compliance requirements. One of the key trends shaping the market is the increasing adoption of integrated facility management solutions, which reflects changing preferences toward operational efficiency, sustainability, and cost optimization across commercial, industrial, and institutional facilities. This trend is reinforced by government-backed initiatives under Saudi Vision 2030, which promote large-scale infrastructure development, urban modernization, and smart city projects across Riyadh, Jeddah, and Dammam.

Another emerging trend is the growing implementation of technology-driven services, driven by digital solutions such as IoT-based monitoring, predictive maintenance, and automated energy management. These developments are further supported by regulatory frameworks including the Saudi Building Code (2018) and the Saudi Energy Efficiency Program (SEEP), which emphasize energy efficiency, safety standards, and sustainability. Consequently, companies are increasingly focusing on value-added services, data-enabled operational insights, and compliance-driven solutions, thereby redefining competitive dynamics within the Saudi Arabian facility management market.

Growth Drivers

The growth of the market landscape is largely supported by large-scale infrastructure development under government initiatives such as Saudi Vision 2030, which continues to generate consistent demand across commercial, industrial, and institutional facilities. Increasing investments in smart city projects, hospitals, educational campuses, and industrial complexes are further accelerating market expansion. Public funding for NEOM, Qiddiya, and other urban development programs is creating substantial opportunities for integrated and technology-enabled facility management solutions.

Additionally, the growing adoption of digital and automated services is playing a crucial role in boosting market penetration. As enterprises and public institutions prioritize operational efficiency, energy management, and regulatory compliance, demand for IoT-enabled monitoring, predictive maintenance, and energy-efficient facility management solutions is expected to remain strong throughout the forecast period. Regulatory frameworks such as the Saudi Building Code (2018) and the Saudi Energy Efficiency Program (SEEP) reinforce compliance-driven adoption, ensuring long-term growth for companies providing advanced facility management services.

Market Restraints / Challenges

Despite favorable growth prospects, the industry faces certain challenges that may limit its expansion. High initial investment requirements for integrated and technology-enabled facility management solutions, such as IoT-based monitoring systems, predictive maintenance platforms, and automated energy management tools, continue to affect profitability and market penetration, particularly among small and mid-sized enterprises. Government reports, including the Saudi Ministry of Municipal and Rural Affairs Infrastructure Development Report 2024 and the Saudi Vision 2030 Public Investment Fund infrastructure updates, indicate that budget constraints and capital allocation limitations in emerging commercial sectors can slow adoption.

Furthermore, shortage of skilled personnel poses operational challenges for facility management service providers. Dependence on trained technicians, certified energy managers, and digital solution specialists can lead to delivery delays, increased operational costs, and scalability issues, impacting overall market performance during periods of economic uncertainty. Government-led workforce development programs, such as the Human Capability Development Program under Vision 2030 and the Technical and Vocational Training Corporation (TVTC) initiatives, aim to mitigate these challenges but require sustained effort to address long-term talent gaps across the sector.

Market Opportunities

The market presents significant opportunities in smart building solutions, particularly driven by technological advancements and government-led urban development projects. Companies offering modular, technology-enabled, and high-performance facility management solutions are well-positioned to capture incremental demand from commercial, industrial, and institutional clients. Government reports, including the Saudi Vision 2030 Infrastructure Development Updates and the Public Investment Fund Smart City Program Report 2025, highlight substantial ongoing investments in smart city initiatives such as NEOM and Qiddiya, creating long-term demand for integrated facility services.

Another key opportunity lies in energy-efficient and sustainability-focused services, where rising investments in digital-enabled monitoring, predictive maintenance, and automated energy management are creating avenues for higher margins and stronger client relationships. Advancements in IoT, AI-based analytics, and smart energy solutions are also expected to enhance operational efficiency, improve compliance with regulatory frameworks such as the Saudi Building Code 2018, and support long-term adoption across commercial and public sector facilities.

Saudi Arabia Facility Management Market Report Coverage

|

Report Metric

|

Details

|

|

Historical Period

|

2020 - 2024

|

|

Base Year Considered

|

2025

|

|

Forecast Period

|

2026 - 2035

|

|

Market Size in 2025

|

U.S.D. 35.30 Billion

|

|

Revenue Forecast in 2035

|

U.S.D. 89.58 Billion

|

|

Growth Rate

|

9.7%

|

|

Segments Covered in the Report

|

Service Type, Offering Type, Mode of Delivery, End-User Industry

|

|

Report Scope

|

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling

|

|

Regions Covered in the Report

|

Western Region, Eastern Province, Central Region, Southern & Northern Regions, Other Regions

|

Saudi Arabia Facility Management Market Segmentation

By Service Type

Hard services are projected to account for approximately 55% of total market revenue in 2025. This reflects the critical role of mechanical, electrical, and plumbing maintenance, preventive upkeep, and compliance-driven operations across industrial, commercial, and public facilities. The consistent requirement for asset reliability, regulatory adherence, and operational continuity supports the dominant market share of hard services.

Soft services contribute roughly 45% of revenue in 2025, driven by increasing demand for cleaning, security, landscaping, and workplace support in corporate offices, retail complexes, and hospitality establishments. This segment is expected to grow at a faster pace during the forecast period due to the expansion of urban infrastructure and smart facility adoption, as well as increasing regulatory emphasis on occupant safety and sustainability.

By Offering Type

Outsourced facility management services are anticipated to represent approximately 62% of market revenue in 2025, supported by organizations seeking cost efficiencies, access to technology-enabled solutions, and consolidated operational management. Outsourcing allows providers to deploy predictive maintenance, energy management, and integrated reporting platforms, improving asset performance and reducing operational risk.

In-house services account for around 38% of revenue, reflecting ongoing demand among institutions and SMEs that maintain selective internal service teams. The in-house segment is expected to grow steadily, driven by increasing investments in staff training, compliance standards, and partial adoption of digital tools to improve operational efficiency.

By Mode of Delivery

Integrated service delivery is projected to hold approximately 48% of total market revenue in 2025, as clients prefer unified operations for performance tracking, compliance, and sustainability. The integrated model is expected to register the fastest growth due to increasing adoption of IoT-enabled monitoring, automated energy management systems, and outcome-oriented facility management strategies aligned with Saudi government regulations and Vision 2030 infrastructure programs.

Bundled services contribute around 30% of revenue in 2025, serving specific multi-discipline requirements within commercial and institutional facilities. Growth in this segment is supported by consolidation trends, where service providers combine selected offerings to optimize cost and ensure operational continuity.

Single service models account for roughly 22% of market revenue in 2025, addressing niche facility needs such as security, cleaning, or landscaping. The segment is expected to grow moderately as organizations increasingly move toward comprehensive or integrated service contracts for efficiency and compliance purposes.

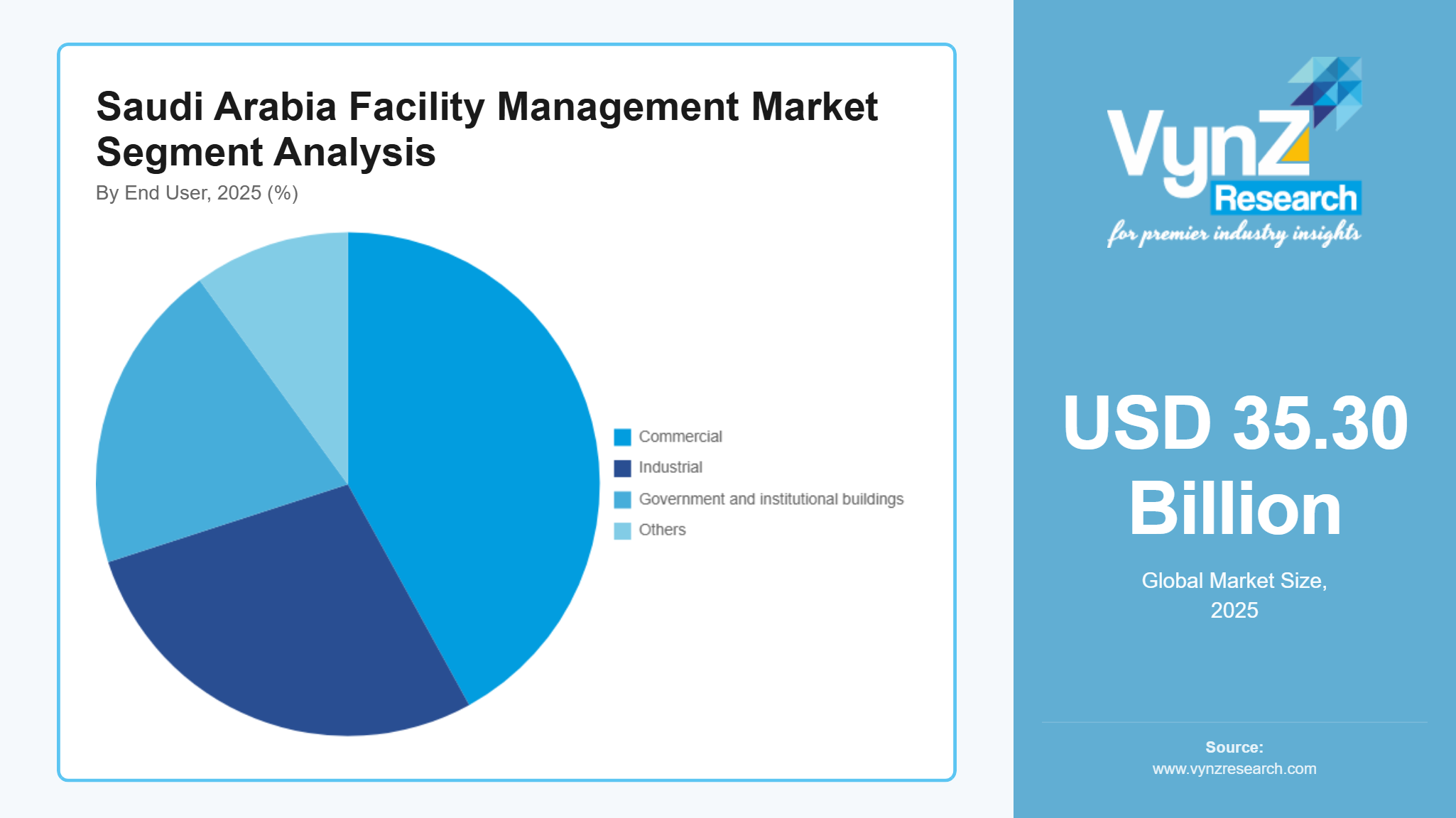

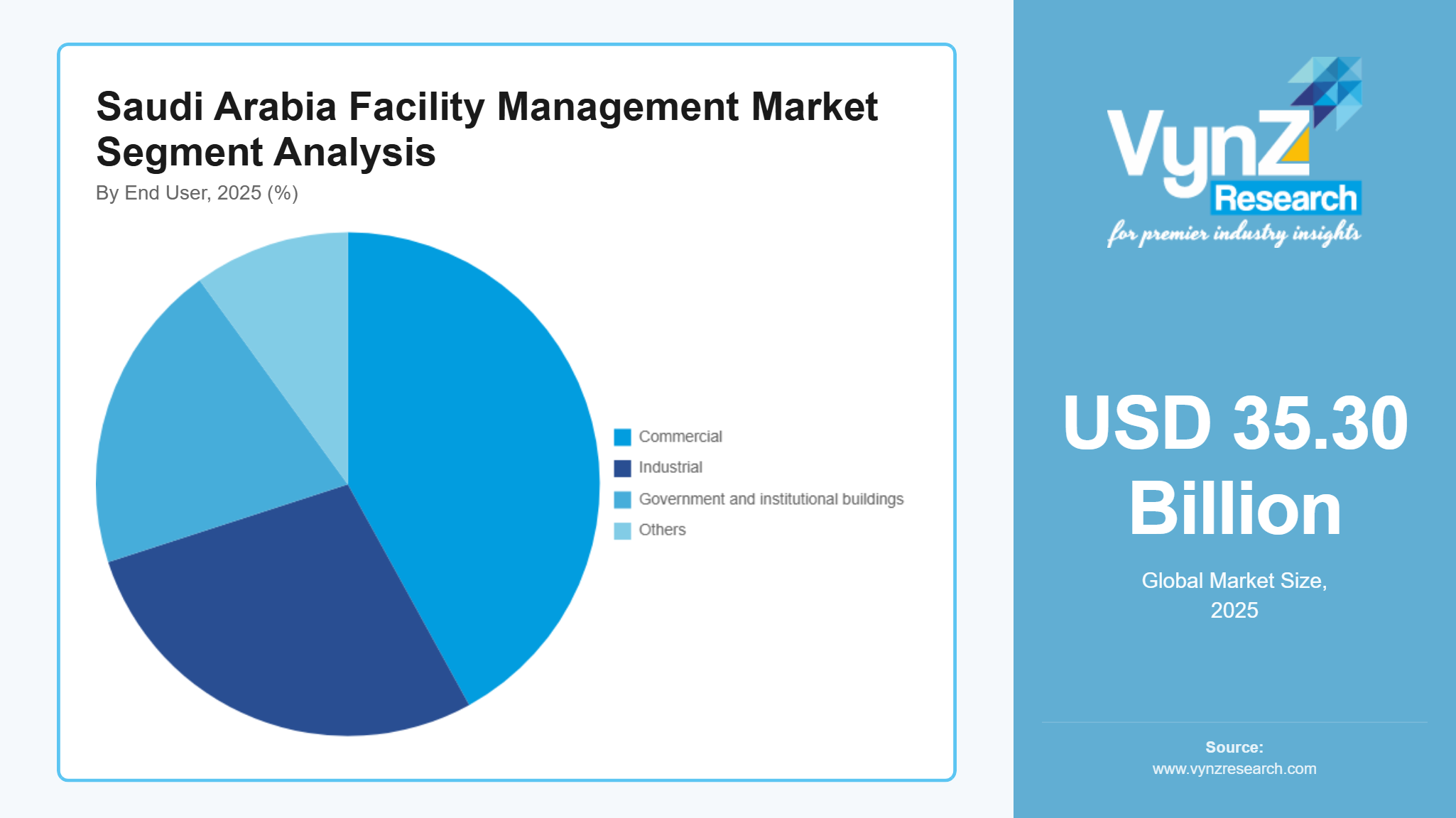

By End-User Industry

Commercial end users accounted for the largest share at about 42% in 2025, supported by the rapid expansion of office complexes, shopping centers, and mixed-use developments in Riyadh, Jeddah, and Dammam. High footfall, urbanization, and infrastructure investments sustain consistent demand for professional facility management services.

Industrial and process facilities represent around 28% of total revenue in 2025, driven by giga-projects in oil, gas, manufacturing, and logistics that require predictive maintenance, energy management, and regulatory compliance. This segment is expected to grow at the fastest rate during the forecast period due to adoption of technology-enabled services and automation solutions.

Government and institutional buildings contribute approximately 20% of market revenue, supported by infrastructure projects in healthcare, education, and administrative facilities. Adoption is driven by mandates under Saudi Vision 2030 emphasizing sustainability, energy efficiency, and operational excellence.

Hospitality and other sectors make up the remaining 10% of revenue in 2025, reflecting hotels, resorts, and entertainment facilities that increasingly require outsourced soft services. Growth is supported by tourism initiatives, hospitality development programs, and enhanced compliance requirements for safety and cleanliness standards.

Regional Insights

Western Region

The Western region of Saudi Arabia accounted for approximately 30% of the Saudi Arabia facility management market in 2025, driven by major infrastructural developments and tourism‑oriented mega projects. Cities such as Jeddah host key transport hubs, including multimodal ports, Haramain high‑speed rail link, and the Red Sea tourism cluster, all of which necessitate comprehensive facility management services across hospitality, transit, and urban infrastructure sectors. Government‑led sustainable tourism strategies under Vision 2030 emphasize zero‑carbon operations and environmental standards across resorts and marinas, boosting demand for advanced facility management capabilities across this region.

Eastern Province

The Eastern Province contributed almost 25% of the market revenue in 2025, underpinned by its role as the Kingdom’s industrial heartland. The presence of oil and gas extraction operations, including unconventional gas development at Jafurah and related upstream facilities, mandates rigorous predictive maintenance, pipeline support services, and camp facilities operations that elevate hard services demand. Municipal modernization initiatives in cities such as Dammam also expand non‑oil facility management requirements, including water public‑private partnerships and smart city components aligned with government economic diversification goals.

Central Region

The Central region is estimated to hold roughly 20% of the facility management market in 2025, supported by rapid corporate, civic, and transport infrastructure expansion in Riyadh. Projects such as the King Salman International Airport extension, Riyadh Metro, and financial district developments drive sustained demand for corporate campus operations, data center management, and integrated asset performance monitoring. Government incentives for special economic zones and urban governance reforms further reinforce long‑term growth prospects, encouraging both domestic and international service providers to scale digital and compliance‑oriented offerings.

Southern and Northern Regions

Collectively, the Southern and Northern regions accounted for approximately 15% of the national market in 2025, supported by emerging residential, commercial, and logistics hubs that are progressively adopting professional facility management solutions. Infrastructure projects in these regions, though smaller in scale compared with major cities, reflect the broader national emphasis on balanced regional development under Saudi Vision 2030, which promotes housing, sanitation, and urban service upgrades across the Kingdom.

Other Regions

The remaining regions of Saudi Arabia made up around 10% of the facility management market in 2025. These areas represent developing urban and industrial zones with growing demand for basic and specialized facility management services. They present strategic long‑term opportunities, particularly as government programs expand connectivity, housing, and economic diversification beyond core metropolitan centers. Overall, roughly 80% of the regional market has been detailed above, with the remaining share attributable to smaller localities and emerging precincts not covered individually here.

Competitive Landscape / Company Insights

The market is moderately competitive, with a mix of global and regional players focusing on service innovation, operational efficiency, and geographic expansion. Companies are increasingly investing in digital tools, predictive maintenance, and smart building solutions to strengthen their position and comply with government regulations such as the Saudi Building Code 2018 and Vision 2030 infrastructure initiatives. Public-private partnerships and urban development programs further influence strategic investments, encouraging providers to adopt sustainable, tech-enabled facility management services.

Mini Profiles

Initial Saudi Group provides integrated hard and soft facility management for commercial, industrial, and institutional clients. Leveraging strong brand recognition and a wide network, it focuses on compliance, energy efficiency, and sustainable operations aligned with Saudi Vision 2030.

Almajal G4S serves premium and corporate segments, specializing in security, cleaning, and technical maintenance. The company combines global expertise with localized operations, using digital monitoring and predictive maintenance to meet regulatory and urban development standards.

Emcor offers facility management, MEP maintenance, and technical support services. Through strategic partnerships and certifications, it expands in industrial and commercial sectors, supporting government infrastructure and smart city projects.

SETE Energy Saudia delivers industrial facility management and technical services for energy and logistics sectors. It emphasizes cost efficiency, compliance, and digital asset monitoring to ensure reliable operations in high-demand facilities.

ZOMCO provides preventive maintenance, energy management, and workplace support. Using local expertise and digital tools, it serves commercial, industrial, and institutional clients while ensuring compliance and operational efficiency under Vision 2030.

Key Players

- Khidmah Sole Proprietorship LLC (Aldar Properties PJSC)

- Almajal

- G4S (Allied Universal)

- Al Suwaidi Holding Company KSA

- El Seif Operation and Maintenance (ESOM)

- Facilities Management Company (FMCO)

- El Seif Operation and Maintenance (ESOM)

- Initial Saudi Group (Alesayi Holding)

- ZOMCO (Zamil Operations & Maintenance) (Zamil Group)

- SETE Energy Saudia for Industrial Projects Ltd (SETE Saudia)

Recent Developments

Novemebr 2025 - Enova shall handle general facility maintenance of Red Sea International Airport. Hard and soft FM services shall be provided by Enova along with energy auditing, technical maintenance, indoor air quality testing, landscaping, and environmentally friendly waste management, to meet sustainability goals. This partnership aligns with Saudi Vision 2030's emphasis on sustainable and effective infrastructure.

October 2025 - Charwood Energy’s construction business has won a new contract with ENGIE Solutions for the installation of a 250 kW wood-fired biomass boiler in Châteaumeillant, France. This program shall help to achieve regional energy transition objectives with the lowering of carbon emissions and shall boost the proportion of renewable energy in public infrastructure. The biomass plant shall provide household hot water and sustainable heating to a number of public building along with a nursing home, a fire and rescue station (SDIS), and a gendarmerie.

July 2025 - Lynskey Engineering Group is expected to continue its course of growth within the Dussmann Technical Solutions division. The acquisition strengthens the Dussmann Technical Solutions division, which was founded in May 2019 and has acquired several other technical services companies, including Irish STS Group, the multinational specialist electrical engineering company to establish and expand the range of engineering services for clients with complex technical demands and mission critical systems in the industrial, energy and data centre sectors.