Global Aseptic Pharma Processing Equipment Market – Analysis and Forecast (2025-2030)

Industry Insight by Component (Processing Equipment (Drying Equipment, Extruders, Mills, Granulation Equipment, Tablet Compression Equipment, Feeders, Fill/Finish Equipment, Mixing Equipment, and Pneumatic Conveying Equipment)and Packaging Equipment (Inspection Machines, Labeling Machines, and Aseptic Packaging Machines), by Application (Ophthalmic Suspensions, Reconstituted Lyophilized Powders for Injection, Sterile Injectables, Aqueous-Based Aerosols for Inhalation, and Others), and by Geography (North America, Europe, Asia-Pacific, Middle East, and Rest of the World)

| Status : Published | Published On : Dec, 2024 | Report Code : VRHC1256 | Industry : Healthcare | Available Format :

|

Page : 200 |

Global Aseptic Pharma Processing Equipment Market – Analysis and Forecast (2025-2030)

Industry Insight by Component (Processing Equipment (Drying Equipment, Extruders, Mills, Granulation Equipment, Tablet Compression Equipment, Feeders, Fill/Finish Equipment, Mixing Equipment, and Pneumatic Conveying Equipment)and Packaging Equipment (Inspection Machines, Labeling Machines, and Aseptic Packaging Machines), by Application (Ophthalmic Suspensions, Reconstituted Lyophilized Powders for Injection, Sterile Injectables, Aqueous-Based Aerosols for Inhalation, and Others), and by Geography (North America, Europe, Asia-Pacific, Middle East, and Rest of the World)

Aseptic Pharma Processing Equipment Market Overview

The Global Aseptic Pharma Processing Equipment Market is anticipated to grow from USD 7.91 billion in 2023 and reach USD 15.75 billion by 2030, exhibiting a compound yearly growth rate of 7.1 percent (CAGR). The processing of pharmaceuticals is the technique of drug manufacturing which includes a range of unit operations like milling, granulation, blending, tablet pressing, coating, filling, sealing, packaging, and others. In terms of quality, the pharmaceutical manufacturing process includes certain standards and manufacturing norms. The aseptic pharma processing equipment market include the increasing demand for sterile pharmaceutical products, stringent regulatory requirements for product safety, and the growing prevalence of chronic diseases requiring injectable medications.

Additionally, the rising adoption of advanced technologies in pharmaceutical manufacturing and the need for improving operational efficiency also contribute to market growth.The market for aseptic pharma processing equipment is highly competitive, with several global and regional players offering a wide range of products. These companies invest in research and development activities to introduce innovative and technologically advanced equipment to meet the evolving needs of the pharmaceutical industry.

Aseptic Pharma Processing Equipment Market Segmentation

Insight by Component

The worldwide aseptic pharma processing equipment market is divided into processing and packaging equipment based on component. The processing equipment is further divided into drying equipment, extruders, mills, granulation equipment, tablet compression equipment, feeders, fill/finish equipment, mixing equipment, and pneumatic conveying equipment. The packaging equipment is further divided into inspection machines, labeling machines, and aseptic packaging machines. The aseptic processing equipment dominates the market owing to increased demand, associated high cost per unit and is used to manufacture any drug i.e., solid or liquid in a sterile environment. Furthermore, aseptic pharmaceutical processing is the procedure for drug manufacture and can be broken into a wide range of operations which includes blending, granulation, milling, coating, tablet pressing, filling, and others. In terms of quality, the aseptic pharmaceutical production process includes certain needs and manufacturing norms. As a result, pharmaceutical businesses are required to follow excellent manufacturing processes.

Insight by Application

On the basis of application, the global aseptic pharma processing equipment market is segregated into ophthalmic suspensions, reconstituted lyophilized powders for injection, sterile injectables, aqueous-based aerosols for inhalation, and others. The ophthalmic suspension dominates the aseptic pharma processing equipment market as the ophthalmic products are intended for use on the conjunctiva or eyelids and contain at least one active pharmaceutical ingredient. Because the risks of microbiological content or bio-burden in raw materials are very high, aseptic pharma processing becomes extremely important. As a result, the worldwide aseptic pharma processing equipment market will benefit from this use.

Global Aseptic Pharma Processing Equipment Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 7.91 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 15.75 Billion |

|

Growth Rate |

7.1% |

|

Segments Covered in the Report |

By Component and By Application |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Industry Dynamics

Industry Trends

The increased demand by contract manufacturing organizations (CMOS) for aseptic manufacturing of pharmaceutical products, and mounting development in the pharmaceutical industry are the key trends in the global aseptic pharma processing & packaging equipment market.

Aseptic Pharma Processing Equipment Market Growth Drivers

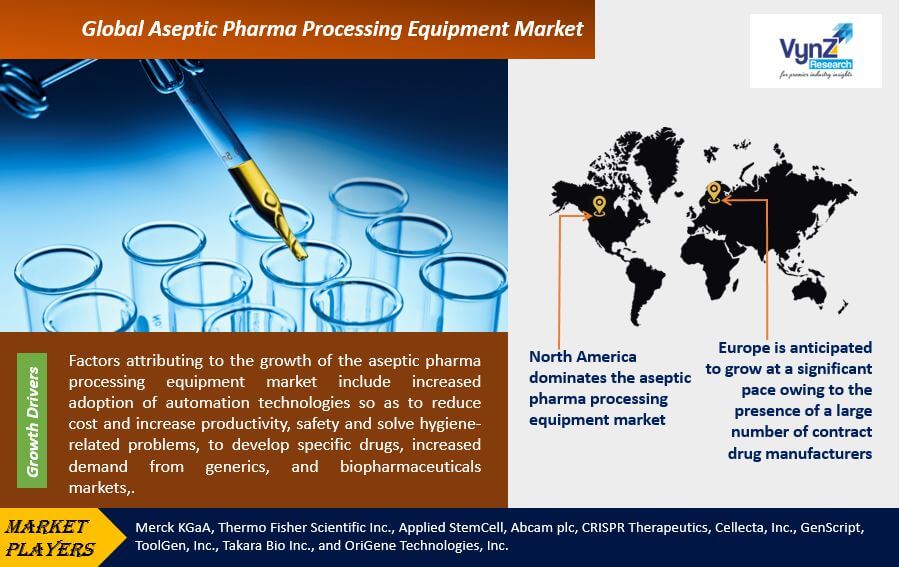

Factors attributing to the growth of the aseptic pharma processing equipment market include increased adoption of automation technologies so as to reduce cost and increase productivity, safety and solve hygiene-related problems, to develop specific drugs, increased demand from generics, and biopharmaceuticals markets,. Furthermore, the mounting demand for generics and biopharmaceutical markets, reduced risk of high-cost product loss, increased healthcare expenditure, rising prominence of chronic diseases, and the advent of new drugs will drive the growth of the market.

Aseptic Pharma Processing Equipment Market Challenges

Lack of skilled personnel having the technical knowledge to set up manufacturing plants for aseptic pharma processing increased the cost of aseptic processing equipment, and preference for refurbished equipment due to high investment in aseptic processing equipment may pose challenges for the growth of the aseptic pharma processing equipment market.

Aseptic Pharma Processing Equipment Market Opportunities

The growing elderly population, high prevalence of infectious diseases, and increased focus on targeted therapy have all contributed to a significant increase in pharmaceutical sales in recent years. Pharmaceutical product growth has been spurred by increased global demand for drugs. With an increase in research and clinical trials undertaken by pharmaceutical producers, productivity has improved in the pharmaceutical manufacturing industry.

Recent Developments By the Key Players

SP Manufacturing (SPM), a leader in Electronic Manufacturing Services (EMS), is strengthening its global presence with two major moves: opening a new manufacturing facility in Senai, Malaysia, and successfully acquiring the Asian operations of the Ideal Jacobs Corporation.

SPX FLOW's APV brand introduces the APV DW+ Positive Displacement Pump, the next generation of its renowned DW Series. Engineered to optimize the processing of high-value, high-viscosity products, the DW+ pump portfolio offers 27 different models and serves diverse industries, including food and beverage, personal care, pet food and industrial applications, like paint and resins. The APV DW+ pump's pulsation-free, low-shear design protects downstream equipment by minimizing vibration, noise and pressure surges.

Aseptic Pharma Processing Equipment Market Geographic Overview

North America dominates the aseptic pharma processing equipment market owing to standardized regulatory measures for the sterilization of pharmaceuticals, improvement in healthcare infrastructure, and many companies providing aseptic processing. Moreover, significant investment by biotechnology companies to enhance their manufacturing facilities and developed automation technologies, and increased per capita income will accelerate the growth of the market.

Europe is anticipated to grow at a significant pace owing to the presence of a large number of contract drug manufacturers (CDMOs) and increased demand for aseptic processing in European countries will further accelerate the growth of the region. Furthermore, Germany and Denmark are the biggest exporters of drugs and medicine, driving the growth of the aseptic pharma processing equipment market.

Aseptic Pharma Processing Equipment Market Competitive Insight

There is a lot of competition in the aseptic pharmaceutical processing and packaging equipment market, but product differentiation is less. The significant increase in demand for biopharmaceuticals like vaccines and other treatments has resulted in an expansion in aseptic processing facilities for standardized pharmaceutical manufacturing. Furthermore, as the number of CDMOs has grown, specific aseptic processing technologies are increasingly adopted. Major strategies have been included by companies such as Baxter International to expand their market presence through crucial innovations.

Some of the key players in the aseptic pharma processing equipment market include :

- SP Industries, Inc.

- Robert Bosch GmbH

- ILC Dover LP

- Dupont

- Rommelag Kunststoff-Maschinen Vertriebsgesellschaft mbH

- SPX Flow Inc.

- Becton, Dickinson, and Company

- Amcor plc

- GEA Group Aktiengesellschaft

- JBT

The Aseptic Pharma Processing Equipment Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2023–2030.

Segments Covered in the Report

- By Component

- Processing Equipment

- Drying Equipment

- Extruders, Mills

- Granulation Equipment

- Tablet Compression Equipment

- Feeders

- Fill/Finish Equipment

- Mixing Equipment

- Pneumatic Conveying Equipment

- Packaging Equipment

- Inspection Machines

- Labeling Machines

- Aseptic Packaging Machines

- Processing Equipment

- By Application

- Ophthalmic Suspensions

- Reconstituted Lyophilized Powders for Injection

- Sterile Injectables

- Aqueous-Based Aerosols for Inhalation

- Others

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

To explore more about this report - Request a free sample copy

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Aseptic Pharma Processing Equipment Market