Global Emerging Infectious Disease Diagnostics Market – Analysis and Forecast (2026-2035)

Industry Insight by Technology (polymerase chain reaction (PCR), isothermal nucleic acid amplification technology (INAAT), next-generation sequencing (NGS), immunodiagnostics, and other technologies), Type of Infection (bacterial, viral, fungal, and other infections), Disease Type (respiratory infections, sexually transmitted infections (STIs), gastrointestinal infections, and other infections), Application (laboratory testing and point-of-care testing), End-User (hospitals and clinics, diagnostics laboratories, and other end-users) and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

| Status : Published | Published On : Jan, 2026 | Report Code : VRHC1279 | Industry : Healthcare | Available Format :

|

Page : 220 |

Global Emerging Infectious Disease Diagnostics Market – Analysis and Forecast (2026-2035)

Industry Insight by Technology (polymerase chain reaction (PCR), isothermal nucleic acid amplification technology (INAAT), next-generation sequencing (NGS), immunodiagnostics, and other technologies), Type of Infection (bacterial, viral, fungal, and other infections), Disease Type (respiratory infections, sexually transmitted infections (STIs), gastrointestinal infections, and other infections), Application (laboratory testing and point-of-care testing), End-User (hospitals and clinics, diagnostics laboratories, and other end-users) and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Emerging Infectious Disease Diagnostics Market Overview

Emerging infectious disease diagnostics involves the identification and monitoring of novel pathogens that pose a threat to public health. Utilizing advanced technologies such as PCR, genomics, and immunodiagnostics, it aims to rapidly detect and characterize new infectious agents. This field plays a crucial role in outbreak response, enabling early containment measures and treatment strategies. Continuous surveillance, international collaboration, and the integration of artificial intelligence enhance the ability to swiftly diagnose and understand emerging diseases. By combining molecular biology with innovative diagnostic tools, Emerging Infectious Disease Diagnostics contributes to global efforts in preemptively managing and mitigating the impact of infectious threats on a population's well-being.

The global emerging infectious disease diagnostics market was worth USD 20.36 billion in 2025 and is estimated to reach around USD 21.50 billion in 2026. It is projected to reach around USD 35.05 billion by 2035, expanding at a CAGR of about 5.58 % during the forecast period from 2026 to 2035. The growing demand for emerging infectious disease diagnostics is driven by the increasing incidence of novel pathogens, rapid technological advancements in diagnostic tools, heightened awareness due to past pandemics, global surveillance efforts, and the imperative for prompt identification to facilitate timely public health responses.

Geographically, the global emerging infectious disease diagnostics market is expanding rapidly in North America, Europe, and the Asia Pacific, as a result of the robust healthcare infrastructure, advanced diagnostic technologies, proactive government initiatives, heightened awareness post-pandemics, and increasing research investments; however, the market confronts constraints such as regulatory hurdles, limited access to advanced diagnostic technologies in developing regions, resource constraints, and the unpredictable nature of emerging diseases. Overall, the emerging infectious disease diagnostics market offers potential prospects for market participants to develop and fulfill the growing needs of wide range of industries including hospitals and clinics, and diagnostics laboratories.

Emerging Infectious Disease Diagnostics Market Segmentation

Insight by Technology

- polymerase chain reaction (PCR)

- isothermal nucleic acid amplification technology (INAAT)

- next-generation sequencing (NGS)

- immunodiagnostics

- other technologies

Based on technology, the global emerging infectious disease diagnostics market is segmented into polymerase chain reaction (PCR), isothermal nucleic acid amplification technology (INAAT), next-generation sequencing (NGS), immunodiagnostics, and other technologies. Polymerase Chain Reaction (PCR) dominated the global emerging infectious disease diagnostics market in 2022 due to its precision, sensitivity, and rapid results. PCR enables targeted amplification of genetic material for specific pathogen detection. Examples include its pivotal role in diagnosing COVID-19, allowing rapid and accurate identification of the SARS-CoV-2 virus. While isothermal nucleic acid amplification technology (INAAT) offers simplicity, PCR's established track record and widespread adoption make it the current frontrunner. However, the landscape may evolve with ongoing advancements; for instance, Next-Generation Sequencing (NGS) is increasingly utilized for comprehensive genomic analysis in emerging infectious disease research.

Insight by Type of Infection

- bacterial

- viral

- fungal

- other infections

Based on type of infection, the global emerging infectious disease diagnostics market is segmented into bacterial, viral, fungal, and other infections. Viral infections currently dominate the global emerging infectious disease diagnostics market due to their propensity for rapid transmission and global impact. Notably, the rise of novel viruses, such as the COVID-19 in 2020 and the Zika virus, which emerged in 2015, and the ongoing challenges posed by influenza variants, underscores the need for effective viral diagnostics. These instances highlight the urgency and demand for diagnostics that can swiftly and accurately identify viral pathogens, shaping the market's focus towards viral detection technologies in the ongoing efforts to tackle emerging infectious diseases.

Insight by Disease Type

- respiratory infections

- sexually transmitted infections (STIs)

- gastrointestinal infections

- other infections

Based on disease type, the global emerging infectious disease diagnostics market is segmented into respiratory infections, sexually transmitted infections (STIs), gastrointestinal infections, and other infections. Respiratory infections currently dominate the global emerging infectious disease diagnostics market due to their widespread occurrence and significant public health impact. Notably, the COVID-19 pandemic, caused by the SARS-CoV-2 virus, has underscored the critical need for accurate and rapid respiratory diagnostics. With its unprecedented global impact since December 2019, COVID-19 has driven a surge in demand for respiratory diagnostics, emphasizing the urgency for effective tools in managing emerging infectious diseases. This trend is likely to persist as respiratory pathogens continue to pose substantial threats to public health worldwide.

Insight by Application

- laboratory testing

- point-of-care testing

Based on application, the global emerging infectious disease diagnostics market is segmented into laboratory testing and point-of-care testing. Laboratory testing currently dominate the global emerging infectious disease diagnostics market due to its capacity for high-throughput, comprehensive analysis, and precise identification of pathogens. The significance of labs was evident during the COVID-19 pandemic, where central laboratories played a crucial role. For instance, the widespread use of RT-PCR tests, like the TaqPath COVID-19 Combo Kit, in labs facilitated large-scale testing since its FDA approval in July 2020. The extensive capabilities of labs, coupled with their infrastructure for complex testing procedures, make them essential in managing and understanding emerging infectious diseases, ensuring accurate diagnosis and facilitating effective public health responses.

Insight by End-User

- hospitals and clinics

- diagnostics laboratories

- other end-users

Based on end-user, the global emerging infectious disease diagnostics market is segmented into hospitals and clinics, diagnostics laboratories, and other end-users. Hospitals and clinics dominated the global emerging infectious disease diagnostics market in 2023 due to their role as primary healthcare settings, where timely and accurate diagnostics are pivotal. The COVID-19 pandemic, exemplified by the rapid deployment of diagnostic tests in healthcare facilities globally, underscores this dominance. For instance, the widespread adoption of point-of-care PCR tests in hospitals, like the Xpert Xpress SARS-CoV-2 test, has enabled swift diagnosis since its FDA approval in March 2020. The centralization of diagnostic resources in hospitals and clinics ensures efficient patient management and containment of emerging infectious diseases, solidifying their position in the diagnostics market.

Global Emerging Infectious Disease Diagnostics Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 20.36 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 35.05 Billion |

|

Growth Rate |

5.58% |

|

Segments Covered in the Report |

By Technology, By Type of Infection, By Disease Type, By Application, By End-Use Industry |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and South America |

Industry Dynamics

Emerging Infectious Disease Diagnostics Market Growth Drivers

Continuous evolution of diagnostic technologies

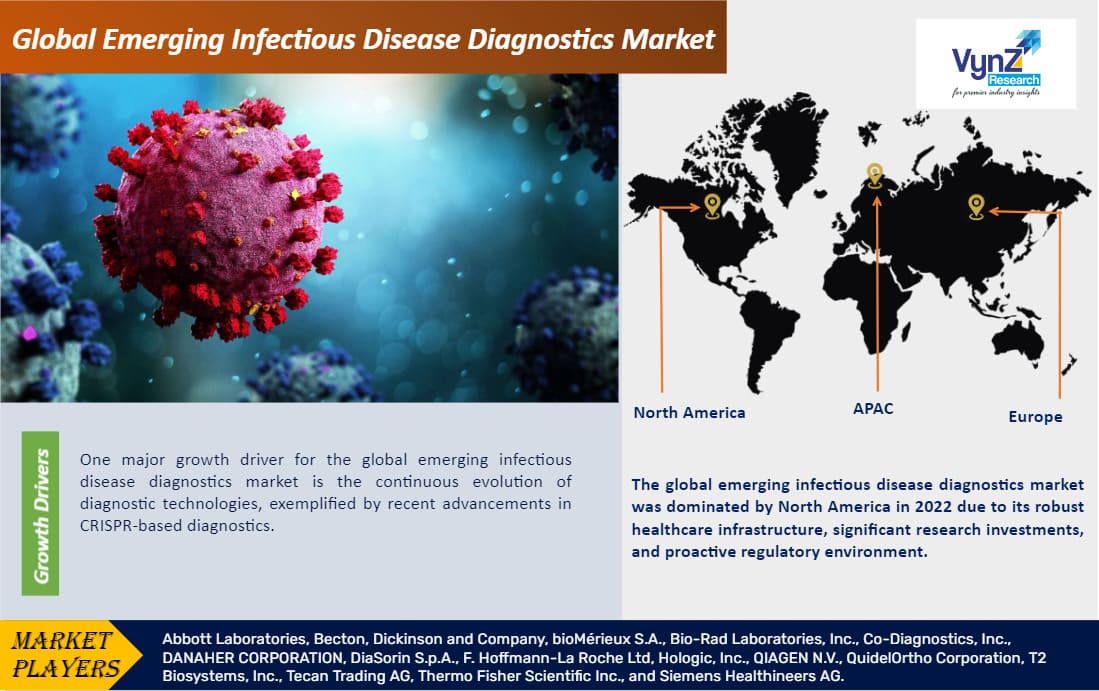

One major growth driver for the global emerging infectious disease diagnostics market is the continuous evolution of diagnostic technologies, exemplified by recent advancements in CRISPR-based diagnostics. In August 2021, the FDA granted Emergency Use Authorization for Sherlock BioSciences' Sherlock CRISPR SARS-CoV-2 kit, showcasing the potential of CRISPR technology in rapid and specific pathogen detection. CRISPR-based diagnostics offer advantages like high sensitivity, specificity, and potential for multiplexing, revolutionizing infectious disease diagnostics. The adaptability and precision of such technologies contribute significantly to the market's growth, fostering innovation in diagnostic approaches. As these technologies become more accessible and versatile, they are expected to reshape the landscape of emerging infectious disease diagnostics, driving market expansion and improving response capabilities in the face of novel pathogens.

Increasing emphasis on decentralized testing and point-of-care diagnostics

Another major growth driver for the global emerging infectious disease diagnostics market is the increasing emphasis on decentralized testing and point-of-care diagnostics. This shift is evident with the emergence of portable and rapid testing solutions, exemplified by the LumiraDx Platform. In October 2022, LumiraDx received FDA clearance for its SARS-CoV-2 Antigen Test on the LumiraDx Platform, showcasing the trend towards accessible and swift diagnostics. Point-of-care testing reduces turnaround time, enhances patient management, and aids in early containment efforts during outbreaks. The demand for user-friendly, on-site diagnostics, especially in resource-limited settings, is driving innovation in portable technologies, contributing significantly to market growth as healthcare systems globally prioritize decentralized testing for emerging infectious diseases.

Emerging Infectious Disease Diagnostics Market Challenge

Complex regulatory approval process

A major challenge for the global emerging infectious disease diagnostics market is the potential for regulatory complexities and delays in the approval process. Stringent regulatory requirements, varying across regions, can hinder the timely introduction of new diagnostic technologies. For instance, navigating the regulatory landscape for novel diagnostic tests, like those developed during public health emergencies, such as the COVID-19 pandemic, can be intricate. Delays in regulatory approvals may impede the rapid deployment of essential diagnostic tools, impacting the market's responsiveness to emerging infectious threats and hindering the ability to swiftly implement effective diagnostic solutions.

Emerging Infectious Disease Diagnostics Market Geographic Overview

-

North America

-

Europe

-

Asia Pacific (APAC)

-

Middle East and Africa (MEA)

-

South America

The global emerging infectious disease diagnostics market is segmented into North America, Europe, the Asia-Pacific, South America, and the Middle East and Africa region. The global emerging infectious disease diagnostics market was dominated by North America in 2023 due to its robust healthcare infrastructure, significant research investments, and proactive regulatory environment. Notably, the FDA's swift approvals of diagnostic tools during the COVID-19 pandemic, such as the FDA Emergency Use Authorization for Roche's Elecsys IL-6 test in June 2020, demonstrate the region's ability to efficiently respond to emerging threats. The concentration of major diagnostic companies, research facilities, and a well-established healthcare system enhances North America's position in driving innovation and rapid deployment of advanced diagnostics, consolidating its dominance in the global market.

Emerging Infectious Disease Diagnostics Market Competitive Insight

Abbott Laboratories is a leading player in the global emerging infectious disease diagnostics market, known for its innovative diagnostic solutions. Abbott's ID NOW COVID-19 test, granted Emergency Use Authorization by the FDA in March 2020, exemplifies their commitment to rapid and on-site testing. This molecular test provides results in just minutes, facilitating quick decision-making in healthcare settings. Abbott's global presence and extensive portfolio contribute to its dominance in infectious disease diagnostics, addressing challenges posed by emerging pathogens.

Bio-Rad Laboratories is a key player with a strong focus on infectious disease diagnostics. The company's Bio-Plex 2200 system offers multiplex testing capabilities, allowing simultaneous detection of various pathogens. This technology streamlines the diagnostic process, enhancing efficiency and accuracy. Bio-Rad's commitment to research and development is evident in their BioFire FilmArray system, which enables syndromic testing for a broad range of infectious diseases. These innovative solutions position Bio-Rad as a major influencer in the global emerging infectious disease diagnostics market, addressing the evolving landscape of infectious threats.

Recent Development by Key Players

UK-based Oxford Nanopore Technologies and Boston-based Day Zero Diagnostics announced partnership to develop a rapid diagnostic solution for bloodstream infections. The integrated system aims to provide same-day identification and genomic-based antibiotic susceptibility profiling without the need for blood culture. Leveraging Oxford Nanopore's high-throughput sequencing and Day Zero Diagnostics' AI-driven microbial identification technology, the collaboration seeks regulatory approvals, including from the U.S. FDA.

BD (Becton, Dickinson, and Company) - has launched the BD Vacutainer® UltraTouch™ Push Button Blood Collection Set in India to minimize patient pain and discomfort as well as enable single prick success during blood collection process.

Key Players Covered in the Report

Abbott Laboratories, Becton, Dickinson and Company, bioMérieux S.A., Zero Day Diagnostics, Bio-Rad Laboratories, Inc., Co-Diagnostics, Inc., DANAHER CORPORATION, DiaSorin S.p.A., F. Hoffmann-La Roche Ltd, Hologic, Inc., QIAGEN N.V., QuidelOrtho Corporation, T2 Biosystems, Inc., Tecan Trading AG, Thermo Fisher Scientific Inc., and Siemens Healthineers AG.

The emerging infectious disease diagnostics market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2026–2035.

Segments Covered in the Report

-

By Technology

-

Polymerase Chain Reaction (PCR)

-

Isothermal Nucleic Acid Amplification Technology (INAAT)

-

Next-Generation Sequencing (NGS)

-

Immunodiagnostics

-

Other Technologies

-

By Type of Infection

-

Viral

-

Bacterial

-

Fungal

-

Others

-

By Disease Type

-

Respiratory Infections

-

Sexually Transmitted Infections (STIs)

-

Gastrointestinal Infections

-

Other Infections

-

By Application

-

Laboratory Testing

-

Point-of-Care Testing

-

End-User

-

Hospitals and Clinics

-

Diagnostics Laboratories

-

Other End-User

Region Covered in the Report

-

North America

-

U.S.

-

Canada

-

Mexico

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

Rest of Europe

-

Asia-Pacific (APAC)

-

China

-

Japan

-

India

-

South Korea

-

Rest of Asia-Pacific

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

U.A.E

-

South Africa

-

Rest of MEA

-

South America

-

Argentina

-

Brazil

-

Chile

-

Rest of South America

Primary Research Interviews Breakdown

%20System%20Market.png)

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Emerging Infectious Disease Diagnostics Market