- 1-888-253-3960

- enquiry@vynzresearch.com

-

This is lorem ipsum doller

- Home /

- ICT & Media /

- Artificial Intelligence in Cybersecurity Market

- Home >

- ICT & Media >

- Artificial Intelligence in Cybersecurity Market

Artificial Intelligence (AI) in Cybersecurity Market Size & Share | Growth Forecast Report (2026-2035)

Industry Insight by Offering Type (Solutions, Services), by Deployment Mode (Cloud based, On premise, Hybrid), by Organization Size (Large enterprises, Small and medium enterprises), by End User (BFSI, IT and telecom, Healthcare, Government, Industrial and others)

| Status : Published | Published On : Jan, 2026 | Report Code : VRICT5210 | Industry : ICT & Media | Available Format :

|

Page : 190 |

Artificial Intelligence (AI) in Cybersecurity Market Size & Share | Growth Forecast Report (2026-2035)

Industry Insight by Offering Type (Solutions, Services), by Deployment Mode (Cloud based, On premise, Hybrid), by Organization Size (Large enterprises, Small and medium enterprises), by End User (BFSI, IT and telecom, Healthcare, Government, Industrial and others)

Artificial Intelligence in Cybersecurity Market Overview

The global artificial intelligence (AI) in cybersecurity market which was valued at approximately USD 29.61 billion in 2025 and is estimated to rise further up to almost USD 35.97 billion in 2026, is projected to reach around USD 207.58 billion by 2035, expanding at a CAGR of about 21.5% during the forecast period from 2026 to 2035.

Market expansion is primarily supported by the increasing sophistication and frequency of cyber threats, the growing emphasis on proactive threat detection, and the integration of AI powered analytics for real time risk mitigation. Rising demand for automated intrusion detection and threat intelligence solutions continues to drive enterprise adoption.

Adoption is reinforced by organizations’ emphasis on operational resilience, regulatory compliance, and cost-effective security management, aligned with formal AI in cybersecurity frameworks and standards promoted by government and intergovernmental agencies. Programs led by the U.S. Cybersecurity and Infrastructure Security Agency, the European Union Agency for Cybersecurity, and the OECD encourage standardized AI deployment, real time monitoring, and predictive security analytics. These frameworks support robust AI model governance, continuous threat evaluation, and mitigation strategies across critical infrastructure and enterprise networks.

Government backed cybersecurity initiatives, investment in AI driven monitoring platforms, and public-private partnerships continue to sustain market growth across North America, Europe, and Asia Pacific. National AI research strategies, digital infrastructure programs, and financial incentives for AI integration reinforce adoption across multiple sectors including banking, healthcare, energy, and public services. AI powered security solutions enable real time threat detection, automated response, and predictive risk management, making them critical to enterprise and governmental cybersecurity strategies worldwide.

AI in Cybersecurity Market Dynamics

Market Trends

The AI in cybersecurity industry is witnessing a structural shift toward automated and intelligence-driven security frameworks, aligned with global digital security strategies and national AI programs. Policy frameworks supported by the U.S. Cybersecurity and Infrastructure Security Agency (CISA), the European Union Agency for Cybersecurity (ENISA), and OECD guidance emphasize predictive threat detection, automated risk assessment, and continuous monitoring to improve organizational resilience and operational efficiency. This has accelerated the adoption of machine learning-based intrusion detection systems, AI-powered endpoint security, and predictive analytics platforms across enterprises and critical infrastructure sectors.

Financial services, healthcare, energy, and government sectors are increasingly deploying cloud-enabled AI security solutions, advanced threat intelligence platforms, and behavioral analytics to counter sophisticated cyberattacks. Government-backed initiatives such as the U.S. National AI Research Resource Task Force, ENISA cybersecurity capacity building programs, and the Asia Pacific Cybersecurity Strategy reinforce adoption. Enterprises are focusing on integrated AI threat management, automated compliance reporting, and centralized monitoring, reshaping competitive dynamics and fostering innovation across the cybersecurity solutions landscape.

Growth Drivers

The growth of the market is largely supported by the increasing sophistication and volume of cyber threats, which continues to generate consistent demand across critical infrastructure, financial services, and enterprise IT networks. Rising investments in national cybersecurity infrastructure, AI-enabled monitoring tools, and public-private partnerships are further accelerating market expansion.

Additionally, regulatory compliance requirements and risk management priorities are playing a crucial role in boosting adoption. As organizations prioritize operational resilience, data protection, and automated threat mitigation, demand for AI-driven cybersecurity solutions is expected to remain strong throughout the forecast period. Government-backed initiatives, including the U.S. National Institute of Standards and Technology (NIST) AI security guidelines, ENISA threat intelligence programs, and regional cybersecurity strategies across North America, Europe, and Asia Pacific, continue to encourage enterprises to implement scalable, predictive, and explainable AI security frameworks.

Market Restraints / Challenges

Despite favorable growth prospects, the landscape faces structural challenges that may limit expansion. High implementation costs, such as investment in AI engines, secure cloud infrastructure, and advanced threat intelligence platforms, continue to affect profitability and adoption, particularly among mid-sized enterprises and organizations in emerging economies. Government and regulatory guidance, including U.S. Cybersecurity and Infrastructure Security Agency (CISA) recommendations and European ENISA AI security frameworks, emphasize robust deployment standards that increase initial capital requirements.

Furthermore, dependence on specialized AI models, skilled cybersecurity professionals, and proprietary algorithms poses operational challenges for solution providers. Limited availability of trained personnel, reliance on external technology vendors, and integration complexity can lead to scalability issues, longer deployment cycles, and elevated operational expenditure. Reports from NIST on AI in cybersecurity and OECD guidance on secure AI adoption highlight that insufficient in-house expertise and technology gaps remain key barriers, particularly for smaller organizations navigating complex regulatory landscapes.

Market Opportunities

The market presents significant opportunities through the expansion of AI-driven automated threat detection solutions, particularly driven by technological advancements in machine learning, natural language processing, and real-time analytics. Companies offering scalable, cloud-enabled, and high-performance AI cybersecurity platforms are well-positioned to capture demand from large enterprises, government agencies, and critical infrastructure operators seeking proactive security frameworks.

Another key opportunity lies in the rising adoption of AI for regulatory compliance and risk monitoring. Growing investments in specialized AI-enabled security services, such as automated compliance reporting, fraud detection, and threat intelligence integration, are creating avenues for higher margins and long-term client relationships. Government-led initiatives, including the U.S. National AI Research Resource Task Force, ENISA threat intelligence programs, and Asia Pacific cybersecurity modernization plans, are expected to enhance demand for intelligent automation tools, improve operational resilience, and foster adoption of predictive security solutions across sectors worldwide.

Global Artificial Intelligence in Cybersecurity Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 29.61 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 207.58 Billion |

|

Growth Rate |

21.5% |

|

Segments Covered in the Report |

Offering Type, Deployment Mode, Organization Size, End User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia Pacific, Other Regions |

AI in Cybersecurity Market Segmentation

By Offering Type

Solutions are estimated to hold approximately 70% of the total market revenue in 2025, supported by the essential role of integrated AI driven platforms that span threat detection, endpoint protection, network analytics, and identity management, reflecting broad applicability across critical infrastructure and enterprise networks.

Services, including implementation consulting, managed detection and response, and model optimization, are projected to register the highest growth rate of about 24% during the forecast period, driven by rising demand for outsourced expertise, continuous threat hunting, and compliance automation, as organizations seek lifecycle support and cost-efficient operational frameworks. Increasing adoption of AI based cyber defense across BFSI, healthcare, and government verticals continues to support segment level expansion.

By Deployment Mode

Cloud based deployment is estimated to account for roughly 59% of total revenue in 2025, reflecting enterprise preference for scalable, centralized AI analytics that support real time threat intelligence and rapid model updates.

On premise solutions, often adopted by highly regulated sectors and critical infrastructure providers, compose the remainder and are expected to grow at about 22% CAGR during the forecast period due to data sovereignty and latency concerns.

Hybrid deployment, combining local processing with cloud orchestrated control, is also gaining traction with an estimated growth rate of 26%, driven by organizations seeking balanced performance, compliance alignment, and flexibility in distributed architectures.

By Organization Size

Large enterprises accounted for approximately 66% of total revenue in 2025, underpinned by deep security budgets, complex attack surfaces, and stringent regulatory compliance demands that priorities advanced AI capabilities.

Small and medium enterprises are expected to register the fastest growth during the forecast period, with an estimated CAGR of around 25%, as cloud native AI cybersecurity solutions reduce entry barriers and lower infrastructure overheads. Demand from SMEs is further supported by managed services and outcome based pricing models, enabling lower upfront investment while improving threat response and compliance postures.

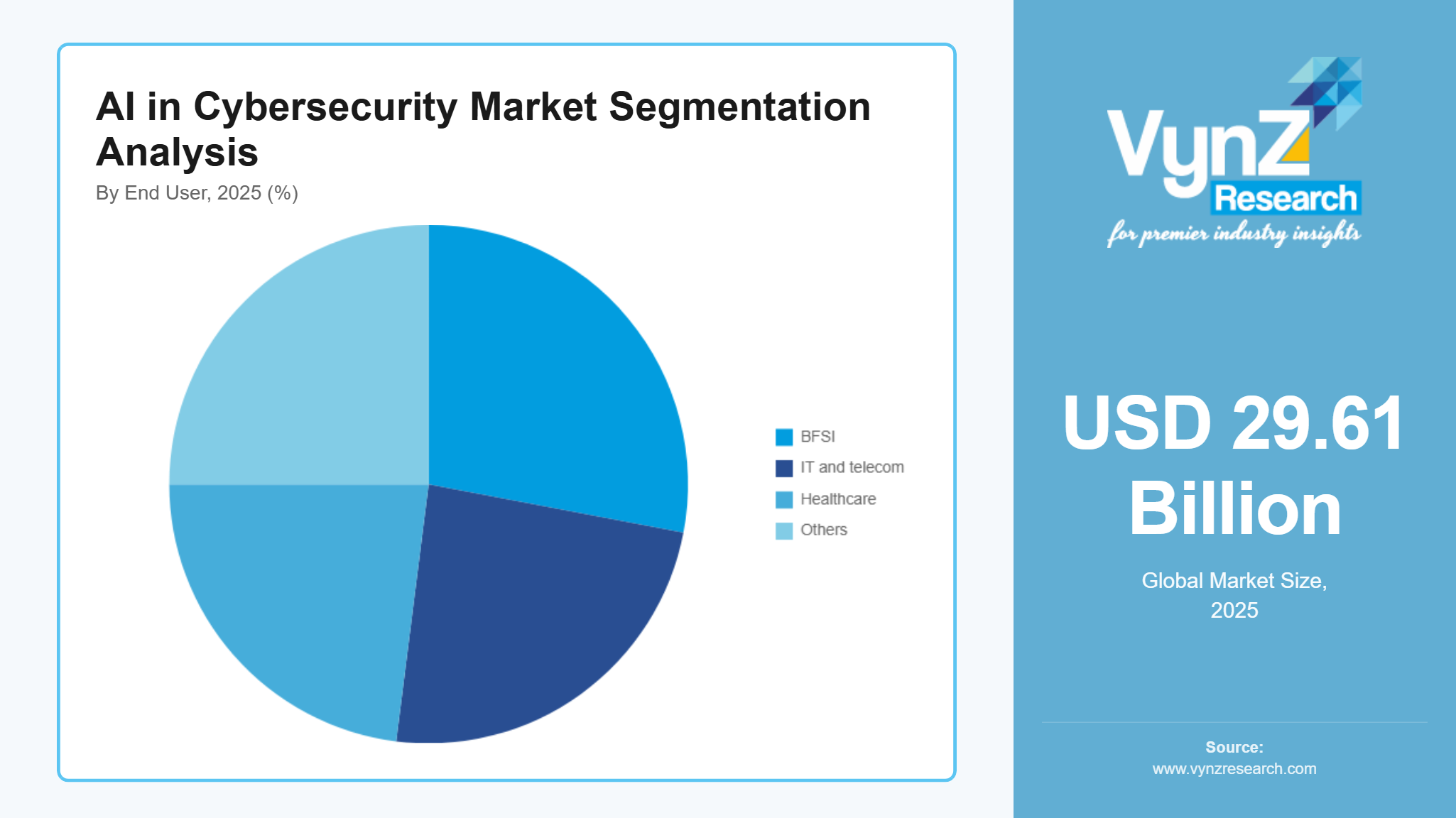

By End User

The BFSI segment accounted for the largest revenue share in 2025 at approximately 28%, supported by stringent data protection regulations, high value assets, and critical transaction security needs.

The IT and telecom sector is one of the fastest growing end use segments, with an estimated growth rate of about 24% driven by 5G expansion, cloud adoption, and elevated threat exposure.

Healthcare is also expanding rapidly with an estimated CAGR close to 23%, as connected medical devices and sensitive patient data create heightened demand for AI driven cybersecurity frameworks. Continued investment in intelligent threat analytics and automated incident response by government agencies and industrial segments further contribute to sustained market demand.

Regional Insights

North America

North America accounted for approximately 30% of the AI in cybersecurity market in 2025, supported by mature digital ecosystems, extensive regulatory frameworks, and strong enterprise investment in advanced security infrastructure. Government guidance such as the U.S. National Institute of Standards and Technology’s (NIST) cybersecurity and AI integration frameworks and the Cybersecurity and Infrastructure Security Agency’s (CISA) AI threat detection initiatives bolster adoption. Financial services, healthcare, and government sectors are major contributors to regional demand as organizations prioritize proactive threat detection, automated compliance monitoring, and real‑time analytics. Enterprise adoption trends combined with public‑sector cybersecurity enhancements and digital resilience strategies continue to fuel market performance across key hubs including the United States and Canada.

Europe

Europe represented an estimated 22% share of the AI in cybersecurity market in 2025, driven by stringent data protection regulations, coordinated policy frameworks, and digital transformation mandates. Regulatory bodies including the European Union Agency for Cybersecurity (ENISA) and initiatives under the EU AI Act reinforce secure AI deployment and continuous threat intelligence exchange. Financial services, telecommunications, and energy sectors are increasingly adopting AI‑based security solutions to satisfy compliance, resilience, and risk management objectives. Government‑backed programs that focus on AI enabled cybersecurity capacity building and cross‑border information sharing further strengthen regional growth and institutional confidence in AI driven defense systems.

Asia Pacific

Asia Pacific accounted for approximately 26% of global market revenue in 2025, underpinned by rapid digitalization, expanding enterprise IT adoption, and national cybersecurity strategies. Central banks, financial regulators, and digital economy agencies across major economies promote AI cybersecurity integration through policy support and public‑private partnerships. Demand from sectors such as finance, telecommunications, and government services is increasing due to rising threat sophistication and digital platform penetration. Government‑backed initiatives focused on smart infrastructure, digital identity protection, and critical asset security are reinforcing adoption of AI‑driven analytics and automated response systems across the region’s major commercial hubs.

Other Regions

Other regions, including Latin America, the Middle East, and Africa, collectively contribute approximately 22% of the global AI in cybersecurity market in 2025. Growth in these regions is supported by gradual strengthening of digital regulations, expanding cloud adoption, and investments in secure infrastructure by public authorities and key enterprises. While adoption is comparatively lower than in North America, Europe, and Asia Pacific, these regions present long‑term opportunities as policy frameworks evolve and demand for AI‑enabled security solutions increases. The remaining share of the market is covered by regions not detailed above, reflecting balanced global estimates without exceeding 100%.

Competitive Landscape / Company Insights

The AI in cybersecurity market is moderately to highly competitive, with global and regional players emphasizing AI model innovation, automated threat detection, and secure analytics platforms. Leading companies including IBM, Microsoft, Google Cloud, Palo Alto Networks, and CrowdStrike focus on advanced R&D, cloudbased security solutions, and regulatory compliance. Adoption is reinforced by government-backed frameworks such as the U.S. NIST AI and cybersecurity guidelines, the EU AI Act, and ENISA recommendations, which promote responsible AI deployment, model governance, and enhanced cybersecurity. These initiatives encourage vendors to strengthen market position and secure long-term enterprise and public-sector contracts worldwide.

Mini Profiles

CrowdStrike builds cloud-native endpoint protection tools with strong emphasis on speed and lightweight performance. Its threat-hunting features appeal to large enterprises that want real-time visibility.

Palo Alto Networks offers a broad mix of firewalls, cloud-security solutions and AI-driven analytics, helping firms set up zero-trust models and standardized controls across networks and endpoints.

Darktrace focuses on behavior-oriented cybersecurity, using self-learning AI to detect irregularities and initiate quick automated responses across dynamic environments.

Microsoft integrates AI into its cloud, identity and productivity suites. Its deep telemetry and enterprise reach allow it to deploy unified threat-intelligence tools at scale.

IBM Security blends AI, SOAR capabilities and threat intelligence, mostly catering to regulated industries with hybrid setups.

Cisco relies on its longstanding network expertise, embedding AI into access controls, endpoint tools and real-time monitoring systems.

Key Players

- Samsung Electronics Co, Ltd

- NVIDIA (US)

- Intel (US)

- Xilinx Inc. (US)

- Samsung Electronics Co., Ltd (South Korea)

- Micron Technology, Inc. (US)

- IBM Corporation (US)

- Amazon Web Services, Inc. (US)

- Microsoft (US)

- Palo Alto Networks Inc. (US)

- Trellix (US)

- CrowdStrike (US)

- NortonLifeLock (US)

- Cylance Inc. (US)

- ThreatMetrix Inc. (US)

- Securonix Inc. (US)

- Sift Science (US)

- Acalvio Technologies (US)

- Darktrace (UK)

- SparkCognition Inc. (US)

- Fortinet (US)

- Check Point Software Technologies, Ltd (US)

- Zimperium (US)

- High-Tech Bridge (Switzerland)

- Deep Instinct (US)

- SentinelOne (US)

- Feedzai (US)

- Vectra (US)

- Argus Cyber Security (Israel)

- Nozomi Networks (US)

- BitSight Technologies (US)

- Kaspersky Lab (Russia)

- Bitdefender (Romania)

- ESET (US)

Recent Developments

January 2026 - To increase its browser protection and identity security capabilities, CrowdStrike Holdings will purchase SGNL and Seraphic Security. With additional in-country cloud installations in Saudi Arabia, India, and the United Arab Emirates, the business is expanding its Global Data Sovereignty project. Additionally, CrowdStrike and Nord Security have partnered to provide small and midsize organizations with cybersecurity capabilities driven by artificial intelligence.

January 2026 - Georgetown University and Cisco Systems have partnered for a number of years to implement one of the biggest Wi-Fi 7 rollouts in higher education. The initiative intends to provide data-intensive applications for research programs, faculty, and students while modernizing campus connections.

In addition, Cisco and Sharon AI have partnered on an AI infrastructure project targeted at clients in Australia and the larger Asia Pacific area. The Sharon AI partnership is intended to assist government, business, and research clients with AI and cloud workloads.

November 2025 - In an effort to fulfill the critical data demands of the AI era, Palo Alto Networks, the global leader in cybersecurity has acquired Chronosphere, a next-generation observability platform. This acquisition will increase Palo Alto Networks' ability to help companies navigate a world where modern applications and AI workloads require a unified data and security basis. Since the growth of these apps and workloads necessitates constant uptime and resilience, real-time, always-on observability is crucial for success.

Table of Contents for Artificial Intelligence in Cybersecurity Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Offering Type

1.2.2. By

Deployment Mode

1.2.3. By

Organization Size

1.2.4. By

End User

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Offering Type

5.1.1. Solutions

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. Services

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.2. By Deployment Mode

5.2.1. Cloud based

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. On premise

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.2.3. Hybrid

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2035

5.3. By Organization Size

5.3.1. Large enterprises

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Small and medium enterprises

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.4. By End User

5.4.1. BFSI

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2035

5.4.2. IT and telecom

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2035

5.4.3. Healthcare

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2035

5.4.4. Government

5.4.4.1. Market Definition

5.4.4.2. Market Estimation and Forecast to 2035

5.4.5. Industrial and others

5.4.5.1. Market Definition

5.4.5.2. Market Estimation and Forecast to 2035

6. North America Market Estimate and Forecast

6.1. By

Offering Type

6.2. By

Deployment Mode

6.3. By

Organization Size

6.4. By

End User

6.4.1.

U.S. Market Estimate and Forecast

6.4.2.

Canada Market Estimate and Forecast

6.4.3.

Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By

Offering Type

7.2. By

Deployment Mode

7.3. By

Organization Size

7.4. By

End User

7.4.1.

Germany Market Estimate and Forecast

7.4.2.

U.K. Market Estimate and Forecast

7.4.3.

France Market Estimate and Forecast

7.4.4.

Italy Market Estimate and Forecast

7.4.5.

Spain Market Estimate and Forecast

7.4.6.

Russia Market Estimate and Forecast

7.4.7.

Rest of Europe Market Estimate and Forecast

8. Asia-Pacific (APAC) Market Estimate and Forecast

8.1. By

Offering Type

8.2. By

Deployment Mode

8.3. By

Organization Size

8.4. By

End User

8.4.1.

China Market Estimate and Forecast

8.4.2.

Japan Market Estimate and Forecast

8.4.3.

India Market Estimate and Forecast

8.4.4.

South Korea Market Estimate and Forecast

8.4.5.

Vietnam Market Estimate and Forecast

8.4.6.

Thailand Market Estimate and Forecast

8.4.7.

Malaysia Market Estimate and Forecast

8.4.8.

Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By

Offering Type

9.2. By

Deployment Mode

9.3. By

Organization Size

9.4. By

End User

9.4.1.

Brazil Market Estimate and Forecast

9.4.2.

Saudi Arabia Market Estimate and Forecast

9.4.3.

South Africa Market Estimate and Forecast

9.4.4.

U.A.E. Market Estimate and Forecast

9.4.5.

Other Countries Market Estimate and Forecast

10. Company Profiles

10.1. Samsung Electronics Co, Ltd

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.2. NVIDIA (US)

10.2.1.

Snapshot

10.2.2.

Overview

10.2.3.

Offerings

10.2.4.

Financial

Insight

10.2.5. Recent

Developments

10.3. Intel (US)

10.3.1.

Snapshot

10.3.2.

Overview

10.3.3.

Offerings

10.3.4.

Financial

Insight

10.3.5. Recent

Developments

10.4. Xilinx Inc. (US)

10.4.1.

Snapshot

10.4.2.

Overview

10.4.3.

Offerings

10.4.4.

Financial

Insight

10.4.5. Recent

Developments

10.5. Samsung Electronics Co., Ltd (South Korea)

10.5.1.

Snapshot

10.5.2.

Overview

10.5.3.

Offerings

10.5.4.

Financial

Insight

10.5.5. Recent

Developments

10.6. Micron Technology, Inc. (US)

10.6.1.

Snapshot

10.6.2.

Overview

10.6.3.

Offerings

10.6.4.

Financial

Insight

10.6.5. Recent

Developments

10.7. IBM Corporation (US)

10.7.1.

Snapshot

10.7.2.

Overview

10.7.3.

Offerings

10.7.4.

Financial

Insight

10.7.5. Recent

Developments

10.8. Amazon Web Services, Inc. (US)

10.8.1.

Snapshot

10.8.2.

Overview

10.8.3.

Offerings

10.8.4.

Financial

Insight

10.8.5. Recent

Developments

10.9. Microsoft (US)

10.9.1.

Snapshot

10.9.2.

Overview

10.9.3.

Offerings

10.9.4.

Financial

Insight

10.9.5. Recent

Developments

10.10. Palo Alto Networks Inc. (US)

10.10.1.

Snapshot

10.10.2.

Overview

10.10.3.

Offerings

10.10.4.

Financial

Insight

10.10.5. Recent

Developments

10.11. Trellix (US)

10.11.1.

Snapshot

10.11.2.

Overview

10.11.3.

Offerings

10.11.4.

Financial

Insight

10.11.5. Recent

Developments

10.12. CrowdStrike (US)

10.12.1.

Snapshot

10.12.2.

Overview

10.12.3.

Offerings

10.12.4.

Financial

Insight

10.12.5. Recent

Developments

10.13. NortonLifeLock (US)

10.13.1.

Snapshot

10.13.2.

Overview

10.13.3.

Offerings

10.13.4.

Financial

Insight

10.13.5. Recent

Developments

10.14. Cylance Inc. (US)

10.14.1.

Snapshot

10.14.2.

Overview

10.14.3.

Offerings

10.14.4.

Financial

Insight

10.14.5. Recent

Developments

10.15. ThreatMetrix Inc. (US)

10.15.1.

Snapshot

10.15.2.

Overview

10.15.3.

Offerings

10.15.4.

Financial

Insight

10.15.5. Recent

Developments

10.16. Securonix Inc. (US)

10.16.1.

Snapshot

10.16.2.

Overview

10.16.3.

Offerings

10.16.4.

Financial

Insight

10.16.5. Recent

Developments

10.17. Sift Science (US)

10.17.1.

Snapshot

10.17.2.

Overview

10.17.3.

Offerings

10.17.4.

Financial

Insight

10.17.5. Recent

Developments

10.18. Acalvio Technologies (US)

10.18.1.

Snapshot

10.18.2.

Overview

10.18.3.

Offerings

10.18.4.

Financial

Insight

10.18.5. Recent

Developments

10.19. Darktrace (UK)

10.19.1.

Snapshot

10.19.2.

Overview

10.19.3.

Offerings

10.19.4.

Financial

Insight

10.19.5. Recent

Developments

10.20. SparkCognition Inc. (US)

10.20.1.

Snapshot

10.20.2.

Overview

10.20.3.

Offerings

10.20.4.

Financial

Insight

10.20.5. Recent

Developments

10.21. Fortinet (US)

10.21.1.

Snapshot

10.21.2.

Overview

10.21.3.

Offerings

10.21.4.

Financial

Insight

10.21.5. Recent

Developments

10.22. Check Point Software Technologies, Ltd (US)

10.22.1.

Snapshot

10.22.2.

Overview

10.22.3.

Offerings

10.22.4.

Financial

Insight

10.22.5. Recent

Developments

10.23. Zimperium (US)

10.23.1.

Snapshot

10.23.2.

Overview

10.23.3.

Offerings

10.23.4.

Financial

Insight

10.23.5. Recent

Developments

10.24. High-Tech Bridge (Switzerland)

10.24.1.

Snapshot

10.24.2.

Overview

10.24.3.

Offerings

10.24.4.

Financial

Insight

10.24.5. Recent

Developments

10.25. Deep Instinct (US)

10.25.1.

Snapshot

10.25.2.

Overview

10.25.3.

Offerings

10.25.4.

Financial

Insight

10.25.5. Recent

Developments

10.26. SentinelOne (US)

10.26.1.

Snapshot

10.26.2.

Overview

10.26.3.

Offerings

10.26.4.

Financial

Insight

10.26.5. Recent

Developments

10.27. Feedzai (US)

10.27.1.

Snapshot

10.27.2.

Overview

10.27.3.

Offerings

10.27.4.

Financial

Insight

10.27.5. Recent

Developments

10.28. Vectra (US)

10.28.1.

Snapshot

10.28.2.

Overview

10.28.3.

Offerings

10.28.4.

Financial

Insight

10.28.5. Recent

Developments

10.29. Argus Cyber Security (Israel)

10.29.1.

Snapshot

10.29.2.

Overview

10.29.3.

Offerings

10.29.4.

Financial

Insight

10.29.5. Recent

Developments

10.30. Nozomi Networks (US)

10.30.1.

Snapshot

10.30.2.

Overview

10.30.3.

Offerings

10.30.4.

Financial

Insight

10.30.5. Recent

Developments

10.31. BitSight Technologies (US)

10.31.1.

Snapshot

10.31.2.

Overview

10.31.3.

Offerings

10.31.4.

Financial

Insight

10.31.5. Recent

Developments

10.32. Kaspersky Lab (Russia)

10.32.1.

Snapshot

10.32.2.

Overview

10.32.3.

Offerings

10.32.4.

Financial

Insight

10.32.5. Recent

Developments

10.33. Bitdefender (Romania)

10.33.1.

Snapshot

10.33.2.

Overview

10.33.3.

Offerings

10.33.4.

Financial

Insight

10.33.5. Recent

Developments

10.34. ESET (US)

10.34.1.

Snapshot

10.34.2.

Overview

10.34.3.

Offerings

10.34.4.

Financial

Insight

10.34.5. Recent

Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Global Artificial Intelligence in Cybersecurity Market Coverage

Offering Type Insight and Forecast 2026 - 2035

- Solutions

- Services

Deployment Mode Insight and Forecast 2026 - 2035

- Cloud based

- On premise

- Hybrid

Organization Size Insight and Forecast 2026 - 2035

- Large enterprises

- Small and medium enterprises

End User Insight and Forecast 2026 - 2035

- BFSI

- IT and telecom

- Healthcare

- Government

- Industrial and others

Global Artificial Intelligence in Cybersecurity Market by Region

- North America

- By Offering Type

- By Deployment Mode

- By Organization Size

- By End User

- By Country - U.S., Canada, Mexico

- Europe

- By Offering Type

- By Deployment Mode

- By Organization Size

- By End User

- By Country - Germany, U.K., France, Italy, Spain, Russia, Rest of Europe

- Asia-Pacific (APAC)

- By Offering Type

- By Deployment Mode

- By Organization Size

- By End User

- By Country - China, Japan, India, South Korea, Vietnam, Thailand, Malaysia, Rest of Asia-Pacific

- Rest of the World (RoW)

- By Offering Type

- By Deployment Mode

- By Organization Size

- By End User

- By Country - Brazil, Saudi Arabia, South Africa, U.A.E., Other Countries

Vynz Research know in your business needs, you required specific answers pertaining to the market, Hence, our experts and analyst can provide you the customized research support on your specific needs.

After the purchase of current report, you can claim certain degree of free customization within the scope of the research.

Please let us know, how we can serve you better with your specific requirements to your research needs. Vynz research promises for quick reversal for your current business requirements.

- Samsung Electronics Co, Ltd

- NVIDIA (US)

- Intel (US)

- Xilinx Inc. (US)

- Samsung Electronics Co., Ltd (South Korea)

- Micron Technology, Inc. (US)

- IBM Corporation (US)

- Amazon Web Services, Inc. (US)

- Microsoft (US)

- Palo Alto Networks Inc. (US)

- Trellix (US)

- CrowdStrike (US)

- NortonLifeLock (US)

- Cylance Inc. (US)

- ThreatMetrix Inc. (US)

- Securonix Inc. (US)

- Sift Science (US)

- Acalvio Technologies (US)

- Darktrace (UK)

- SparkCognition Inc. (US)

- Fortinet (US)

- Check Point Software Technologies, Ltd (US)

- Zimperium (US)

- High-Tech Bridge (Switzerland)

- Deep Instinct (US)

- SentinelOne (US)

- Feedzai (US)

- Vectra (US)

- Argus Cyber Security (Israel)

- Nozomi Networks (US)

- BitSight Technologies (US)

- Kaspersky Lab (Russia)

- Bitdefender (Romania)

- ESET (US)

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Artificial Intelligence in Cybersecurity Market