Global Polyolefin Pipes Market – Analysis and Forecast (2026-2035)

Industry Insight by Type (PE (Polyethylene) (High-Density Polyethylene (HDPE), Linear Low-Density Polyethylene (LLDPE), Low-Density Polyethylene (LDPE)), PP (Polypropylene), Plastomer, and Others) by Application (Irrigation, Potable And Plumbing, Wastewater Drainage, Power & Communication, Industrial Application, Chemical Transportation, and Others), by Industry Vertical (Building & Construction, Agriculture, Industrial, and Others), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

| Status : Published | Published On : Jul, 2025 | Report Code : VRCH2080 | Industry : Chemicals & Materials | Available Format :

|

Page : 200 |

Global Polyolefin Pipes Market – Analysis and Forecast (2026-2035)

Industry Insight by Type (PE (Polyethylene) (High-Density Polyethylene (HDPE), Linear Low-Density Polyethylene (LLDPE), Low-Density Polyethylene (LDPE)), PP (Polypropylene), Plastomer, and Others) by Application (Irrigation, Potable And Plumbing, Wastewater Drainage, Power & Communication, Industrial Application, Chemical Transportation, and Others), by Industry Vertical (Building & Construction, Agriculture, Industrial, and Others), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Polyolefin Pipes Market Overview

The global polyolefin pipes market is anticipated to grow from USD 18.4 billion in 2025 to USD 24.7 billion by 2035, registering a CAGR of 5.3% during the forecast period 2026-2035. Polyolefins are a family of polypropylene and polyethylene thermoplastics and are mainly produced from natural gas and petroleum through the polymerization processes of ethylene and propylene, respectively.

It is made from olefins/hydrocarbons/monomers and has excellent processability, chemical stability, and long shelf life. It is an extensively used thermoplastic polymer and can be used in a variety of applications like building & construction, chemical transportation, plumbing, packaging, consumer goods, fibers, and textiles. Polyolefins have diverse applications in a wide range of industries and use, from ordinary domestic use to specialized industrial applications, and include packaging, automotive, gas & pressure pipes, films, household wire, textiles, laboratory equipment, leisure & toys, etc.

The COVID-19 pandemic has resulted in a lack of workforce, regulation by the government to close the production facility, reduction in imports and exports, decreased operating capacity of the production facility, and disruption in foam supply chain, thus hampering the growth of the polyolefins market. Moreover, the Outbreak has impacted all industry verticals like building & construction, agriculture, industrial, etc. resulting in reduced demand for polyolefins pipes market.

Polyolefin Pipes Market Segmentation

Insight by Type

Based on type, the global polyolefins market is divided into PE (Polyethylene), PP (Polypropylene), plastomer, and others. The PE is sub-divided into High-Density Polyethylene (HDPE), Linear Low-Density Polyethylene (LLDPE), Low-Density Polyethylene (LDPE). The PE type dominates the polyolefins pipes market as it has increased demand and is used in various industry verticals like packaging, automotive, agriculture, medical, electronics, etc. It is highly adopted in various applications owing to its properties like highly durable, rugged, flexible, chemical resistant, versatile, environmental stress crack resistance, and customizable.

Insight by Application

Based on application, the global polyolefins pipes market is divided into irrigation, potable and plumbing, wastewater drainage, power & communication, industrial application, chemical transportation, and others. The industrial application dominates the global polyolefins pipes market as it is corrosion-resistant, has superior resistance to abrasion and chemical attack, and can withstand harsh and extreme climatic conditions. They can also provide fusion-welded leak-proof jointing and operate at temperatures up to 95°C. Polyolefin pipe systems are quickly becoming the world's most commonly used drinking water, wastewater, and natural gas distribution piping systems.

Insight by Industry Vertical

Based on industry vertical, the global polyolefins pipes market is segregated into building & construction, agriculture, industrial, and others. Agriculture is anticipated to be the fastest-growing market for polyolefins pipes owing to its features such as toughness, corrosion, and chemical resistance, light in weight, cost-effective, and durable leading to an increase in demand for agriculture and irrigation purposes.

Polyolefin Pipes Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018–2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2023 |

$18.4 Billion |

|

Revenue Forecast in 2030 |

$24.7 Billion |

|

Growth Rate |

CAGR 5.3% |

|

Segments Covered in the Report |

By Type, By Application, and By Industry Vertical |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Industry Dynamics

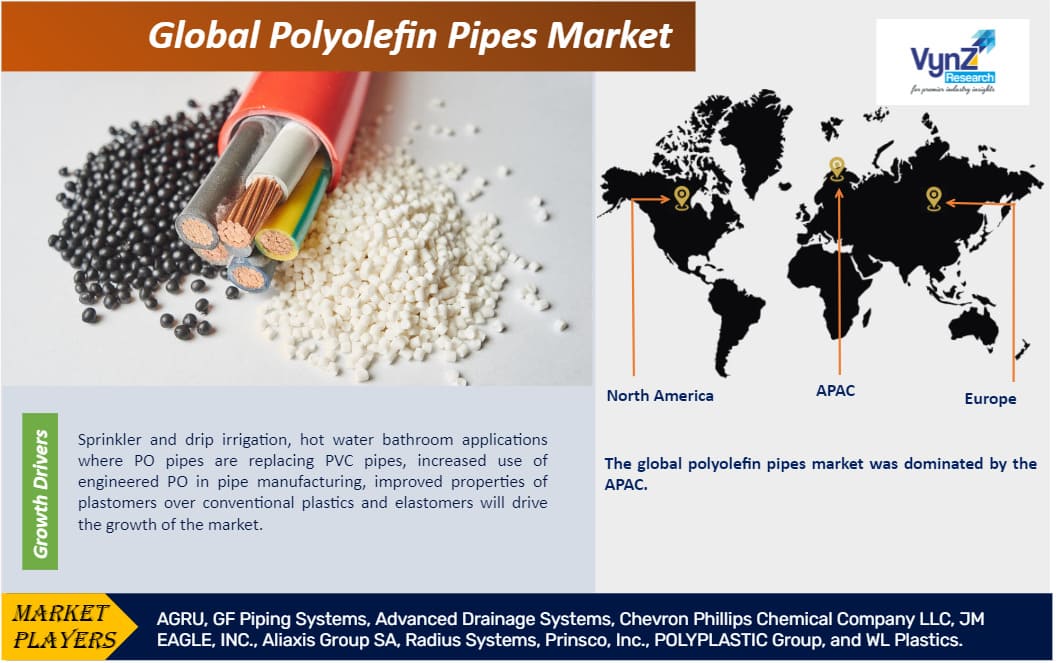

Polyolefin Pipes Market Growth Drivers

Sprinkler and drip irrigation, hot water bathroom applications where PO pipes are replacing PVC pipes, increased use of engineered PO in pipe manufacturing, improved properties of plastomers over conventional plastics and elastomers will drive the growth of the market. In addition, the increased use of bio-based polymers such as PLA and BioPE, as well as local governments' increasing emphasis on rainwater harvesting, will propel the polyolefin pipes market forward. Furthermore, the increased adoption of polypropylene in the medical sector, and growth in the renewable energy sector will accelerate the growth in the market. Polyolefins have properties like low strength and hardness, ductile, good impact strength, water resistance, and durable, and chemical resistance make them suitable for the polyolefins pipes market.

Polyolefin Pipes Market Challenges

Factors affecting the growth of the polyolefin’s pipes market include volatility in raw material prices, increasing concern regarding plastic disposal, economic slowdown amid COVID-19 crisis will hamper the growth of the polyolefins market. Moreover, in spite of high resistance, extreme climatic conditions will influence the installation of the piping system, thus a challenge for the polyolefin pipes market.

Polyolefin Pipes Market Opportunities

The development in the packaging sector in emerging economies like India and China will create opportunities for growth in the polyolefins pipes market during the forecast period 2025-2030. The rising need for PO pipes for communication owing to remote working operations and cooking gas supplies will propel the growth in the market. The industry players are investing in expanding fiber optic networks globally and utility companies are adopting PO pipes that are buried in the ground to distribute natural gas from transmission lines and terminals to the consumers.

Polyolefin Pipes Market Geographic Overview

APAC is anticipated to be the fastest-growing polyolefins pipes market as China is one of the major consumers of polyolefin pipes in terms of volume and value. The less cost of raw material and conveniently available along with reduced cost in setting up production facilities will drive the growth of the polyolefin’s pipes market in the region.

Polyolefin Pipes Market Competitive Insight

The companies are adopting various strategies like novel product development, M&A, collaborations to improve their product portfolio, expand their geographical presence, and sustain their position in the competitive polyolefins market.

GF Piping Systems is one of the leading providers of piping systems for the safe and reliable transfer of liquids and gases. GF Piping Systems are focused on customer-centric innovation and sustainability, despite the ongoing change. Their portfolio includes ABS System, ALUPEX, ChlorFIT® CPVC Schedule 80 Corzan® Piping Systems, ecoFIT, ELGEF Plus, FM PE System, and others.

Radius Systems' goal is to develop innovative polyethylene pipeline components that are both safe and high-quality, as well as manage the pipe's life cycle. The products are used in the utilities and construction industries all around the world, from design to manufacture to installation, repair, and rehabilitation. Their mission is to create the best solutions and products to assist customers in overcoming pipeline construction issues and ensuring that their asset lasts a lifetime. They are involved in various sectors like district heating pipelines, energy & power pipelines, gas pipelines, non-potable water pipelines, and potable water pipelines.Some of the key players in the polyolefins pipes market include AGRU, GF Piping Systems, Advanced Drainage Systems, Chevron Phillips Chemical Company LLC, JM EAGLE, INC., Aliaxis Group SA, Radius Systems, Prinsco, Inc., POLYPLASTIC Group, and WL Plastics.

Recent Developments by Key Players

Advanced Drainage Systems, Inc., a leading provider of advanced water management solutions in the stormwater and on-site septic wastewater industries acquired Jet Polymer Recycling . This acquisition will help ADS Recycling extend its capabilities in order to support future growth while also reinforcing the company's commitment to environmental sustainability.

The Polyplastic Group established a new line at the Sibgazapparat Tyumen pipe facility for the production of three-layer polymer pipes with diameters ranging from 160 to 450 mm. The Rb62 million investment will expand the supply of innovative products with a long service life (over 50 years) and unique technology to strategically significant construction and housing, as well as community services facilities.

.png)

Region Covered in the Report

• North America

- U.S.

- Canada

- Mexico

• Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

• Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

• Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Polyolefin Pipes Market